Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 41

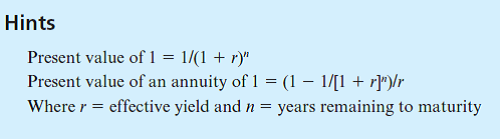

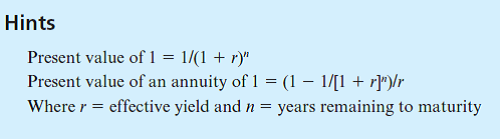

Place Company owns a majority voting interest in Sassano, Inc. On January 1, 2012, Place issued $1,000,000 of 11 percent 10-year bonds at $943,497.77 to yield 12 percent. On January 1, 2014, Sassano purchased all of these bonds in the open market at a price of $904,024.59 with an effective yield of 13 percent.

Required

Using an Excel spreadsheet, do the following:

1. Prepare amortization schedules for the Place Company bonds payable and the Investment in Place Bonds for Sassano, Inc

2. Using the values from the amortization schedules, compute the worksheet adjustment for a December 31, 2014, consolidation of Place and Sassano to reflect the effective retirement of the Place bonds. Formulate your solution to be able to accommodate various yield rates (and therefore prices) on the repurchase of the bonds.

Required

Using an Excel spreadsheet, do the following:

1. Prepare amortization schedules for the Place Company bonds payable and the Investment in Place Bonds for Sassano, Inc

2. Using the values from the amortization schedules, compute the worksheet adjustment for a December 31, 2014, consolidation of Place and Sassano to reflect the effective retirement of the Place bonds. Formulate your solution to be able to accommodate various yield rates (and therefore prices) on the repurchase of the bonds.

Explanation

This question doesn’t have an expert verified answer yet, let Examlex AI Copilot help.

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255