Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 29

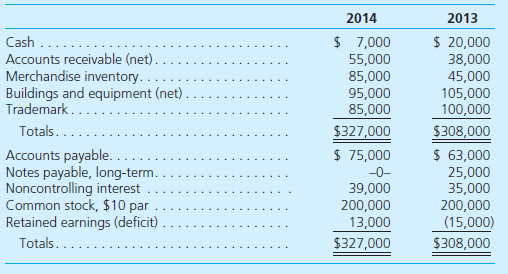

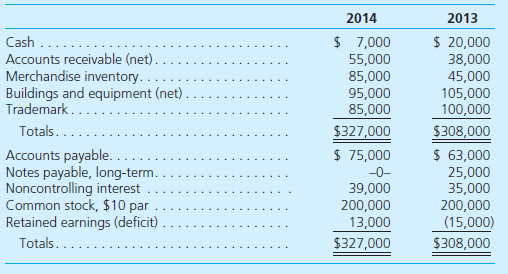

Comparative consolidated balance sheet data for Iverson, Inc., and its 80 percent-owned subsidiary Oakley Co. follow:

Additional Information for Fiscal Year 2014

• Iverson and Oakley's consolidated net income was $45,000.

• Oakley paid $5,000 in dividends during the year. Iverson paid $12,000 in dividends.

• Oakley sold $11,000 worth of merchandise to Iverson during the year.

• There were no purchases or sales of long-term assets during the year.

In the 2014 consolidated statement of cash flows for Iverson Company:

Net cash flows from operating activities were

A) $12,000.

B) $20,000.

C) $24,000.

D) $25,000.

Additional Information for Fiscal Year 2014

• Iverson and Oakley's consolidated net income was $45,000.

• Oakley paid $5,000 in dividends during the year. Iverson paid $12,000 in dividends.

• Oakley sold $11,000 worth of merchandise to Iverson during the year.

• There were no purchases or sales of long-term assets during the year.

In the 2014 consolidated statement of cash flows for Iverson Company:

Net cash flows from operating activities were

A) $12,000.

B) $20,000.

C) $24,000.

D) $25,000.

Explanation

Consolidation is the process of combinin...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255