Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 60

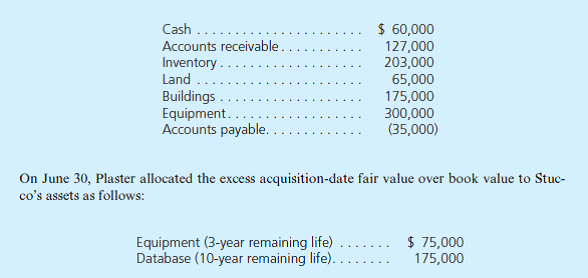

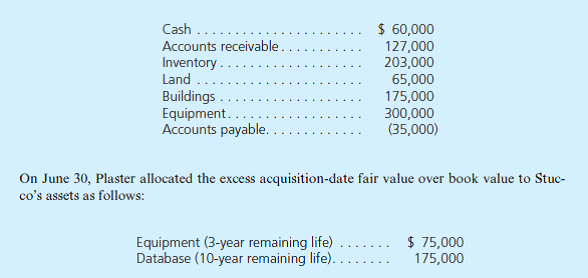

On June 30, 2014, Plaster, Inc., paid $916,000 for 80 percent of Stucco Company's outstanding stock. Plaster assessed the acquisition-date fair value of the 20 percent noncontrolling interest at $229,000. At acquisition date, Stucco reported the following book values for its assets and liabilities:

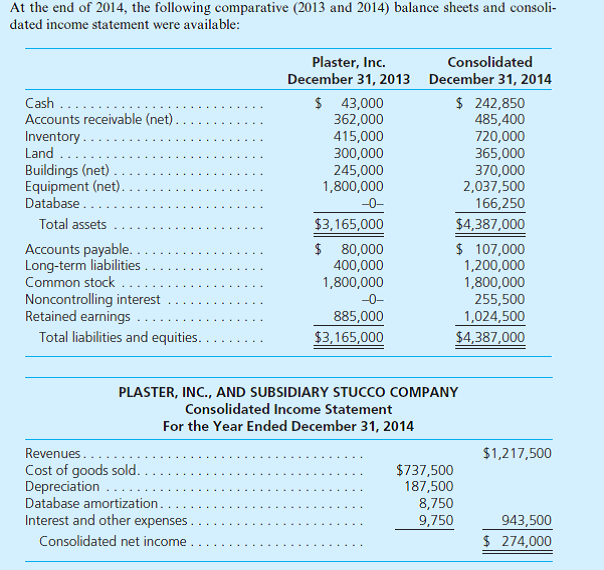

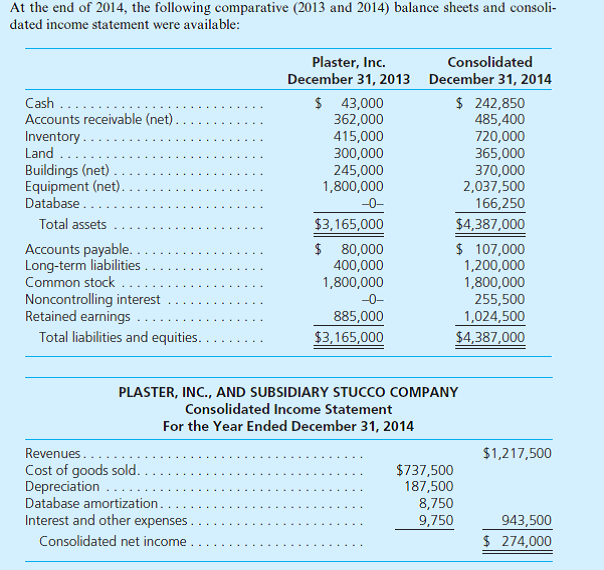

Additional Information for 2014

• On December 1, Stucco paid a $40,000 dividend. During the year, Plaster paid $100,000 in dividends.

• During the year, Plaster issued $800,000 in long-term debt at par.

• Plaster reported no asset purchases or dispositions other than the acquisition of Stucco.

Prepare a 2014 consolidated statement of cash flows for Plaster and Stucco. Use the indirect method of reporting cash flows from operating activities.

Additional Information for 2014

• On December 1, Stucco paid a $40,000 dividend. During the year, Plaster paid $100,000 in dividends.

• During the year, Plaster issued $800,000 in long-term debt at par.

• Plaster reported no asset purchases or dispositions other than the acquisition of Stucco.

Prepare a 2014 consolidated statement of cash flows for Plaster and Stucco. Use the indirect method of reporting cash flows from operating activities.

Explanation

This question doesn’t have an expert verified answer yet, let Examlex AI Copilot help.

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255