Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 35

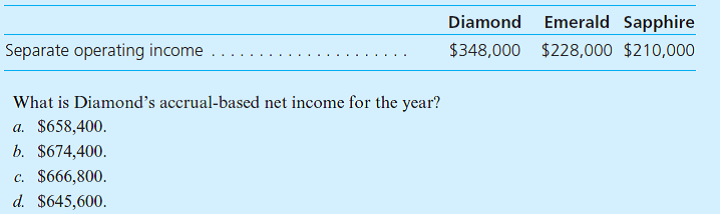

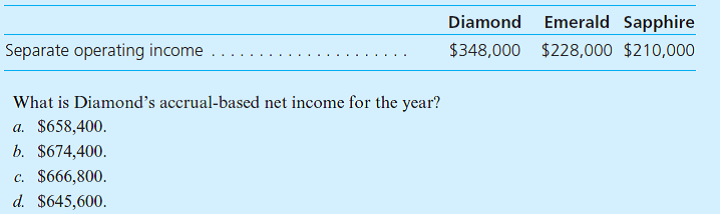

Diamond Company owns 80 percent of Emerald and Emerald owns 90 percent of Sapphire, Inc. Separate operating income totals for the current year follow; they contain no investment income. None of these acquisitions required amortization expense. Included in Sapphire's income is a $50,000 unrealized gain on intra-entity transfers to Emerald.

Explanation

Diamond's accrual- based net income for ...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255