Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 72

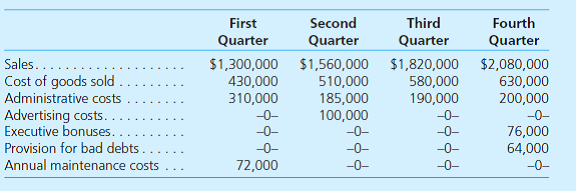

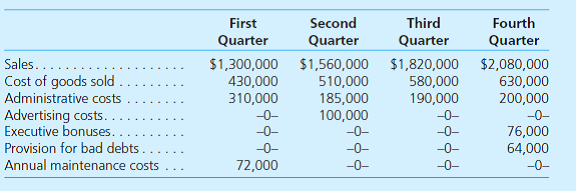

Noventis Corporation prepared the following estimates for the four quarters of the current year:

Additional Information

• First-quarter administrative costs include the $160,000 annual insurance premium.

• Advertising costs paid in the second quarter relate to television advertisements that will be broadcast throughout the entire year.

• No special items affect income during the year.

• Noventis estimates an effective income tax rate for the year of 40 percent.

a. Assuming that actual results do not vary from the estimates provided, determine the amount of net income to be reported each quarter of the current year.

b. Assume that actual results do not vary from the estimates provided except for that in the third quarter, the estimated annual effective income tax rate is revised downward to 38 percent. Determine the amount of net income to be reported each quarter of the current year.

Additional Information

• First-quarter administrative costs include the $160,000 annual insurance premium.

• Advertising costs paid in the second quarter relate to television advertisements that will be broadcast throughout the entire year.

• No special items affect income during the year.

• Noventis estimates an effective income tax rate for the year of 40 percent.

a. Assuming that actual results do not vary from the estimates provided, determine the amount of net income to be reported each quarter of the current year.

b. Assume that actual results do not vary from the estimates provided except for that in the third quarter, the estimated annual effective income tax rate is revised downward to 38 percent. Determine the amount of net income to be reported each quarter of the current year.

Explanation

Net income:

Pre-tax income is calculate...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255