Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 5

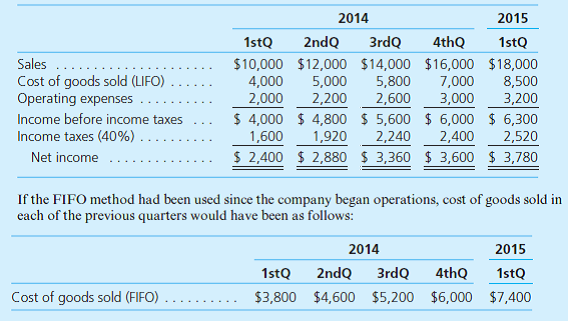

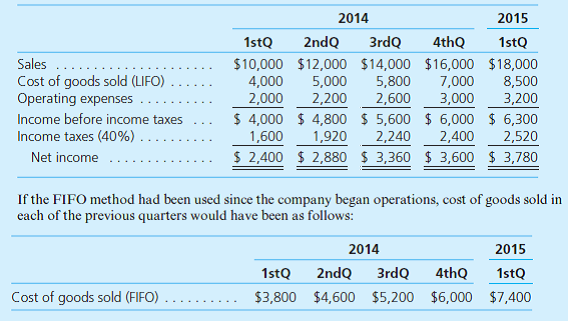

Cambi Company began operations on January 1, 2014. In the second quarter of 2015, it adopted the FIFO method of inventory valuation. In the past, it used the LIFO method. The company's interim income statements as originally reported under the LIFO method follow:

Sales for the second quarter of 2015 are $20,000, cost of goods sold under the FIFO method is $9,000, and operating expenses are $3,400. The effective tax rate remains 40 percent. Cambi Company has 1,000 shares of common stock outstanding.

Prepare a schedule showing the calculation of net income and earnings per share that Cambi reports for the three-month period and the six-month period ended June 30, 2015.

Sales for the second quarter of 2015 are $20,000, cost of goods sold under the FIFO method is $9,000, and operating expenses are $3,400. The effective tax rate remains 40 percent. Cambi Company has 1,000 shares of common stock outstanding.

Prepare a schedule showing the calculation of net income and earnings per share that Cambi reports for the three-month period and the six-month period ended June 30, 2015.

Explanation

The given data in the problem demonstrat...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255