Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 53

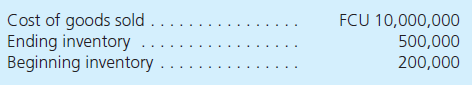

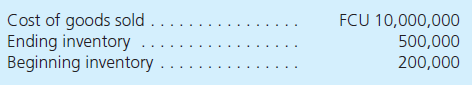

S. company's foreign subsidiary had these amounts in foreign currency units (FCU) in 2015:

The average exchange rate during 2015 was $0.80 = FCU 1. The beginning inventory was acquired when the exchange rate was $1.00 = FCU 1. Ending inventory was acquired when the exchange rate was $0.75 = FCU 1. The exchange rate at December 31, 2015, was $0.70 = FCU 1. Assuming that the foreign country is highly inflationary, at what amount should the foreign subsidiary's cost of goods sold be reflected in the U.S. dollar income statement

A) $7,815,000.

B) $8,040,000.

C) $8,065,000.

D) $8,090,000.

The average exchange rate during 2015 was $0.80 = FCU 1. The beginning inventory was acquired when the exchange rate was $1.00 = FCU 1. Ending inventory was acquired when the exchange rate was $0.75 = FCU 1. The exchange rate at December 31, 2015, was $0.70 = FCU 1. Assuming that the foreign country is highly inflationary, at what amount should the foreign subsidiary's cost of goods sold be reflected in the U.S. dollar income statement

A) $7,815,000.

B) $8,040,000.

C) $8,065,000.

D) $8,090,000.

Explanation

The amount of cost of goods sold is dete...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255