Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 40

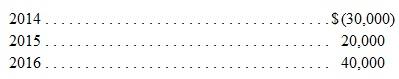

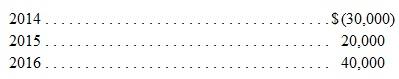

On January 1, 2014, the dental partnership of Left, Center, and Right was formed when the partners contributed $20,000, $60,000, and $50,000, respectively. Over the next three years, the business reported net income and (loss) as follows:

During this period, each partner withdrew cash of $10,000 per year. Right invested an additional $12,000 in cash on February 9, 2015.

At the time that the partnership was created, the three partners agreed to allocate all profits and losses according to a specified plan written as follows:

• Each partner is entitled to interest computed at the rate of 12 percent per year based on the individual capital balances at the beginning of that year.

• Because of prior work experience, Left is entitled to an annual salary allowance of $12,000, and Center is credited with $8,000 per year.

• Any remaining profit will be split as follows: Left, 20 percent; Center, 40 percent; and Right, 40 percent. If a loss remains, the balance will be allocated: Left, 30 percent; Center, 50 percent; and Right, 20 percent.

Determine the ending capital balance for each partner as of the end of each of these three years.

During this period, each partner withdrew cash of $10,000 per year. Right invested an additional $12,000 in cash on February 9, 2015.

At the time that the partnership was created, the three partners agreed to allocate all profits and losses according to a specified plan written as follows:

• Each partner is entitled to interest computed at the rate of 12 percent per year based on the individual capital balances at the beginning of that year.

• Because of prior work experience, Left is entitled to an annual salary allowance of $12,000, and Center is credited with $8,000 per year.

• Any remaining profit will be split as follows: Left, 20 percent; Center, 40 percent; and Right, 40 percent. If a loss remains, the balance will be allocated: Left, 30 percent; Center, 50 percent; and Right, 20 percent.

Determine the ending capital balance for each partner as of the end of each of these three years.

Explanation

Calculate the remaining Income or Loss: ...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255