Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 11

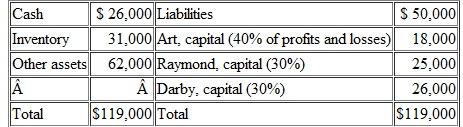

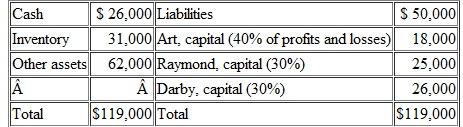

A partnership has the following balance sheet just before final liquidation is to begin:

Liquidation expenses are estimated to be $12,000. The other assets are sold for $40,000. What distribution can be made to the partners

A) -0-to Art, $1,500 to Raymond, $2,500 to Darby.

B) $1,333 to Art, $1,333 to Raymond, $1,334 to Darby.

C) -0- to Art, $ 1,200 to Raymond, $2,800 to Darby.

D) $600 to Art, $1,200 to Raymond, $2,200 to Darby.

Liquidation expenses are estimated to be $12,000. The other assets are sold for $40,000. What distribution can be made to the partners

A) -0-to Art, $1,500 to Raymond, $2,500 to Darby.

B) $1,333 to Art, $1,333 to Raymond, $1,334 to Darby.

C) -0- to Art, $ 1,200 to Raymond, $2,800 to Darby.

D) $600 to Art, $1,200 to Raymond, $2,200 to Darby.

Explanation

Thus, the amounts that would be distribu...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255