Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 41

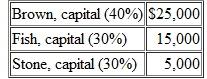

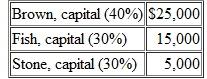

A local partnership has only two assets (cash of $10,000 and land with a cost of $35,000). All liabilities have been paid and the following capital balances are currently being recorded. The partners share profits and losses as follows. All partners are insolvent.

a. If the land is sold for $25,000, how much cash does each partner receive in a final settlement

b. If the land is sold for $15,000, how much cash does each partner receive in a final settlement

c. If the land is sold for $5,000, how much cash does each partner receive in a final settlement

a. If the land is sold for $25,000, how much cash does each partner receive in a final settlement

b. If the land is sold for $15,000, how much cash does each partner receive in a final settlement

c. If the land is sold for $5,000, how much cash does each partner receive in a final settlement

Explanation

Given data can be summarized a...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255