Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 9

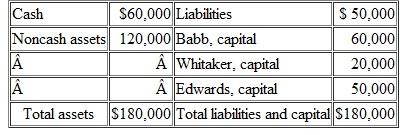

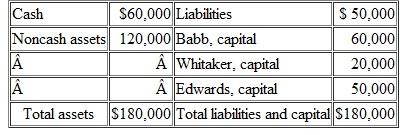

A partnership's balance sheet is as follows:

Babb, Whitaker, and Edwards share profits and losses in the ratio of 4:2:4, respectively. This business is to be terminated, and the partners estimate that $8,000 in liquidation expenses will be incurred. How should the $2,000 in safe cash that is presently held be disbursed

Babb, Whitaker, and Edwards share profits and losses in the ratio of 4:2:4, respectively. This business is to be terminated, and the partners estimate that $8,000 in liquidation expenses will be incurred. How should the $2,000 in safe cash that is presently held be disbursed

Explanation

Maximum Potential Losses and Safe Cash B...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255