Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 45

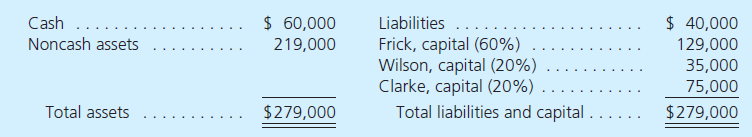

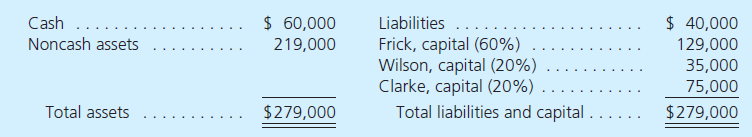

The partnership of Frick, Wilson, and Clarke has elected to cease all operations and liquidate its business property. A balance sheet drawn up at this time shows the following account balances:

Part A

Prepare a predistribution plan for this partnership

Part B

The following transactions occur in liquidating this business:

1. Distributed cash based on safe capital balances immediately to the partners. Liquidation expenses of $8,000 are estimated as a basis for this computation.

2. Sold noncash assets with a book value of $94,000 for $60,000.

3. Paid all liabilities.

4. Distributed cash based on safe capital balances again.

5. Sold remaining noncash assets for $51,000.

6. Paid actual liquidation expenses of $6,000 only.

7. Distributed remaining cash to the partners and closed the financial records of the business permanently.

Produce a final statement of liquidation for this partnership using the predistribution plan to determine payments of cash to partners based on safe capital balances.

Part C

Prepare journal entries to record the liquidation transactions reflected in the final statement of liquidation.

Part A

Prepare a predistribution plan for this partnership

Part B

The following transactions occur in liquidating this business:

1. Distributed cash based on safe capital balances immediately to the partners. Liquidation expenses of $8,000 are estimated as a basis for this computation.

2. Sold noncash assets with a book value of $94,000 for $60,000.

3. Paid all liabilities.

4. Distributed cash based on safe capital balances again.

5. Sold remaining noncash assets for $51,000.

6. Paid actual liquidation expenses of $6,000 only.

7. Distributed remaining cash to the partners and closed the financial records of the business permanently.

Produce a final statement of liquidation for this partnership using the predistribution plan to determine payments of cash to partners based on safe capital balances.

Part C

Prepare journal entries to record the liquidation transactions reflected in the final statement of liquidation.

Explanation

Business combination:

A business combin...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255