Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372 Exercise 6

Determining Financial Statement Effects of Various Transactions

Swish Watch Corporation manufactures, sells, and services expensive watches. The company has been in business for three years. At the end of the previous year, the accounting records reported total assets of $2,255,000 and total liabilities of $1,780,000. During the current year 2013, the following summarized events occurred:

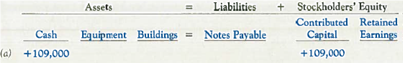

a. Issued additional shares of common stock for $109,000 cash.

b. Borrowed $186,000 cash from the bank and signed a 10-year note.

c. A stockholder sold $5,000 of his stock in Swish Watch Corporation to another investor.

d. Built an addition on the factory buildings for $200,000 and paid cash to the contractor.

e. Purchased equipment for the new addition for $44,000, paying $12,000 in cash and signing a six-month note for the balance.

f. Returned a $4,000 piece of equipment, from ( e ), because it proved to be defective; received a cash refund.

Required:

1. Complete the spreadsheet that follows, using plus (+) for increases and minus ( ) for decreases for each account. The first transaction is used as an example.

2. Did you include event ( c ) in the spreadsheet Why

3. Based on beginning balances plus the completed spreadsheet, provide the following amounts (show computations):

a. Total assets at the end of the year.

b. Total liabilities at the end of the year.

c. Total stockholders' equity at the end of the year.

4. As of December 31, 2013, has the financing for Swish Watch Corporation's investment in assets primarily come from liabilities or stockholders' equity

Swish Watch Corporation manufactures, sells, and services expensive watches. The company has been in business for three years. At the end of the previous year, the accounting records reported total assets of $2,255,000 and total liabilities of $1,780,000. During the current year 2013, the following summarized events occurred:

a. Issued additional shares of common stock for $109,000 cash.

b. Borrowed $186,000 cash from the bank and signed a 10-year note.

c. A stockholder sold $5,000 of his stock in Swish Watch Corporation to another investor.

d. Built an addition on the factory buildings for $200,000 and paid cash to the contractor.

e. Purchased equipment for the new addition for $44,000, paying $12,000 in cash and signing a six-month note for the balance.

f. Returned a $4,000 piece of equipment, from ( e ), because it proved to be defective; received a cash refund.

Required:

1. Complete the spreadsheet that follows, using plus (+) for increases and minus ( ) for decreases for each account. The first transaction is used as an example.

2. Did you include event ( c ) in the spreadsheet Why

3. Based on beginning balances plus the completed spreadsheet, provide the following amounts (show computations):

a. Total assets at the end of the year.

b. Total liabilities at the end of the year.

c. Total stockholders' equity at the end of the year.

4. As of December 31, 2013, has the financing for Swish Watch Corporation's investment in assets primarily come from liabilities or stockholders' equity

Explanation

This question doesn’t have an expert verified answer yet, let Examlex AI Copilot help.

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255