Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372 Exercise 41

Recording Transactions (in a Journal and T-Accounts); Preparing a Trial Balance;

Preparing and Interpreting the Balance Sheet

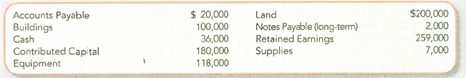

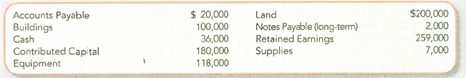

Deliberate Speed Corporation (DSC) was incorporated as a private company on June 1, 2013. The company's accounts included the following at June 30, 2013:

During the month of July, the company had the following activities:

a. Issued 4,000 shares of common stock for $400,000 cash.

b. Borrowed $100,000 cash from a local bank, payable June 30, 2015.

c. Bought a building for $182,000; paid $82,000 in cash and signed a three-year note for the balance.

d. Paid cash for equipment that cost $200,000.

e. Purchased supplies for $30,000 on account.

Required:

1. Analyze transactions ( a )-( e ) to determine their effects on the accounting equation.

2. Record the transaction effects determined in requirement 1 using a journal entry format.

3. Summarize the journal entry effects from requirement 2 using T-accounts.

4. Prepare a classified balance sheet at July 31, 2013.

5. As of July 31, 2013, has the financing for DSC's investment in assets primarily come from liabilities or stockholders' equity

Preparing and Interpreting the Balance Sheet

Deliberate Speed Corporation (DSC) was incorporated as a private company on June 1, 2013. The company's accounts included the following at June 30, 2013:

During the month of July, the company had the following activities:

a. Issued 4,000 shares of common stock for $400,000 cash.

b. Borrowed $100,000 cash from a local bank, payable June 30, 2015.

c. Bought a building for $182,000; paid $82,000 in cash and signed a three-year note for the balance.

d. Paid cash for equipment that cost $200,000.

e. Purchased supplies for $30,000 on account.

Required:

1. Analyze transactions ( a )-( e ) to determine their effects on the accounting equation.

2. Record the transaction effects determined in requirement 1 using a journal entry format.

3. Summarize the journal entry effects from requirement 2 using T-accounts.

4. Prepare a classified balance sheet at July 31, 2013.

5. As of July 31, 2013, has the financing for DSC's investment in assets primarily come from liabilities or stockholders' equity

Explanation

1.

Accounting equation: This is the equa...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255