Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372 Exercise 85

Reporting an Adjusted Income 'Statement

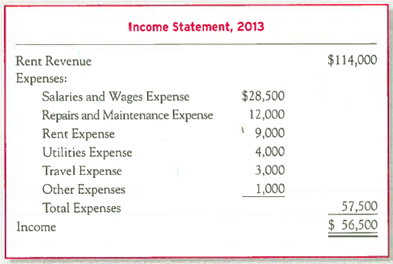

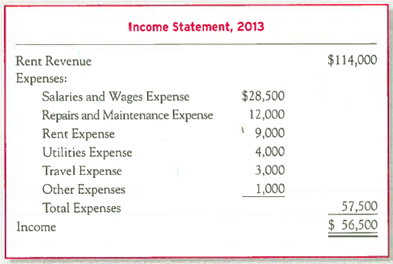

Dyer, Inc., completed its first year of operations on December 31, 2013. Because this is the end of the annual accounting period, the company bookkeeper prepared the following preliminary income statement:

You are an independent CPA hired by the company to audit the firm's accounting systems and financial statements. In your audit, you developed additional data as follows:

a. Wages for the last three days of December amounting to $310 were not recorded or paid.

b. The $400 telephone bill for December 2013 has not been recorded or paid.

c. Depreciation amounting to $23,000 for 2013, was not recorded.

d. Interest of $500 was not recorded on the note payable by Dyer, Inc.

e. The Rental Revenue account includes $4,000 of revenue to be earned in January 2014.

f. Supplies costing $600 were used during 2013, but this has not yet been recorded.

g. The income tax expense for 2013 is $7,000, but it won't actually be paid until 2014.

Required:

1. What adjusting journal entry for each item ( a ) through ( g ) should be recorded at December 31, 2013 If none is required, explain why.

2. Prepare, in proper form, an adjusted income statement for 2013.

3. Did the adjustments have a significant overall effect on the company's net income

Dyer, Inc., completed its first year of operations on December 31, 2013. Because this is the end of the annual accounting period, the company bookkeeper prepared the following preliminary income statement:

You are an independent CPA hired by the company to audit the firm's accounting systems and financial statements. In your audit, you developed additional data as follows:

a. Wages for the last three days of December amounting to $310 were not recorded or paid.

b. The $400 telephone bill for December 2013 has not been recorded or paid.

c. Depreciation amounting to $23,000 for 2013, was not recorded.

d. Interest of $500 was not recorded on the note payable by Dyer, Inc.

e. The Rental Revenue account includes $4,000 of revenue to be earned in January 2014.

f. Supplies costing $600 were used during 2013, but this has not yet been recorded.

g. The income tax expense for 2013 is $7,000, but it won't actually be paid until 2014.

Required:

1. What adjusting journal entry for each item ( a ) through ( g ) should be recorded at December 31, 2013 If none is required, explain why.

2. Prepare, in proper form, an adjusted income statement for 2013.

3. Did the adjustments have a significant overall effect on the company's net income

Explanation

1.

Journal entry for the given transacti...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255