Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372 Exercise 80

Preparing a Bank Reconciliation and Journal Entries, and Reporting Cash

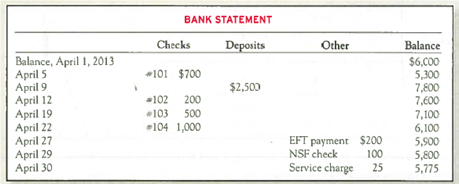

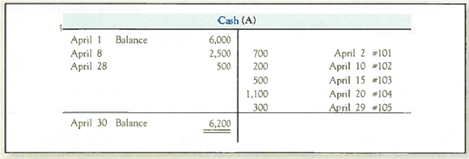

The April 30, 2013, bank statement for KMaxx Company and the April ledger account for cash are summarized here:

No outstanding checks and no deposits in transit were noted in March. However, there are deposits in transit and checks outstanding at the end of April. The electronic funds transfer (EFT) involved an automatic monthly payment to one of KMaxx's creditors. Checks 104 was written for $1,100. The NSF check had been received from a customer.

Required:

1. Prepare a bank reconciliation for April.

TIP : Put a check mark beside each item that appears on both the bank statement and what's already been recorded in the accounting records (shown in the T-account).

Items left unchecked will be used in the bank reconciliation.

2. Give any journal entries that should be made as a result of the bank reconciliation.

TIP : Remember to make entries only for items that affect the company's books, not the bank.

3. What should the balance in the Cash account be after recording the journal entries in requirement 2

4. If the company also has $1,000 of cash on hand (recorded in a separate account), what total amount should the company report as Cash and Cash Equivalents on the April 30 balance sheet

The April 30, 2013, bank statement for KMaxx Company and the April ledger account for cash are summarized here:

No outstanding checks and no deposits in transit were noted in March. However, there are deposits in transit and checks outstanding at the end of April. The electronic funds transfer (EFT) involved an automatic monthly payment to one of KMaxx's creditors. Checks 104 was written for $1,100. The NSF check had been received from a customer.

Required:

1. Prepare a bank reconciliation for April.

TIP : Put a check mark beside each item that appears on both the bank statement and what's already been recorded in the accounting records (shown in the T-account).

Items left unchecked will be used in the bank reconciliation.

2. Give any journal entries that should be made as a result of the bank reconciliation.

TIP : Remember to make entries only for items that affect the company's books, not the bank.

3. What should the balance in the Cash account be after recording the journal entries in requirement 2

4. If the company also has $1,000 of cash on hand (recorded in a separate account), what total amount should the company report as Cash and Cash Equivalents on the April 30 balance sheet

Explanation

1.

The reconciliation statement should ...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255