Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372 Exercise 58

Preparing Multistep Income Statements and Calculating Gross Profit Percentage

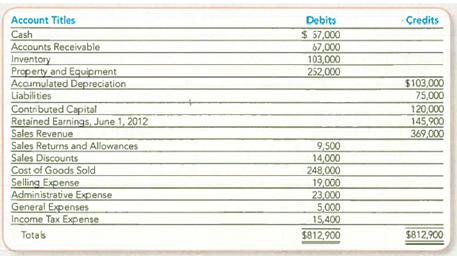

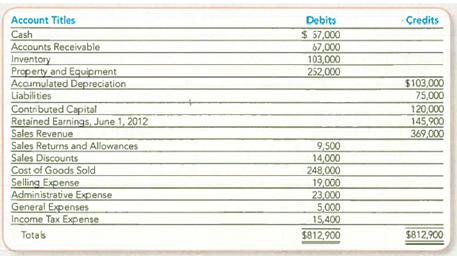

Assume that you have been hired by Big Sky Corporation as a summer intern. The company is in the process of preparing its annual financial statements. To help in the process, you are asked to prepare an income statement for internal reporting purposes and an income statement for external reporting purposes. Your boss has also requested that you determine the company's gross profit percentage based on the statements that you arc to prepare. The following adjusted trial balance was created from the general ledger accounts on May 31, 2013.

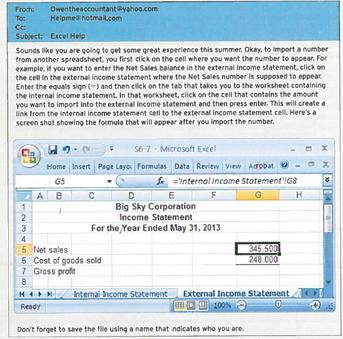

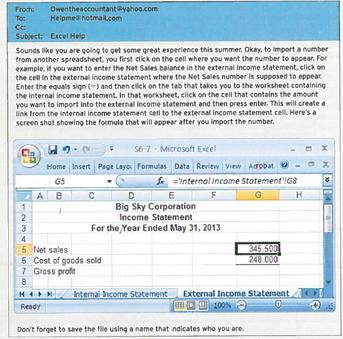

Your boss wants you to create the spreadsheet in a way that automatically recalculates net sales and any other related amounts whenever changes are made to the contra-revenue accounts. To do this, you know that you'll have to use formulas throughout the worksheets and even import or link cells from one worksheet to another. Your friend Owen, an accountant, is willing to help.

Required:

Enter the trial balance information into a spreadsheet and complete the following:

1. Prepare a multistep income statement that would be used for internal reporting purposes. Classify sales returns and allowances and sales discounts as contra-revenue accounts.

2. Prepare a multistep income statement that would be used for external reporting purposes, beginning with the amount for Net Sales.

3. Compute the gross profit percentage.

Assume that you have been hired by Big Sky Corporation as a summer intern. The company is in the process of preparing its annual financial statements. To help in the process, you are asked to prepare an income statement for internal reporting purposes and an income statement for external reporting purposes. Your boss has also requested that you determine the company's gross profit percentage based on the statements that you arc to prepare. The following adjusted trial balance was created from the general ledger accounts on May 31, 2013.

Your boss wants you to create the spreadsheet in a way that automatically recalculates net sales and any other related amounts whenever changes are made to the contra-revenue accounts. To do this, you know that you'll have to use formulas throughout the worksheets and even import or link cells from one worksheet to another. Your friend Owen, an accountant, is willing to help.

Required:

Enter the trial balance information into a spreadsheet and complete the following:

1. Prepare a multistep income statement that would be used for internal reporting purposes. Classify sales returns and allowances and sales discounts as contra-revenue accounts.

2. Prepare a multistep income statement that would be used for external reporting purposes, beginning with the amount for Net Sales.

3. Compute the gross profit percentage.

Explanation

This question doesn’t have an expert verified answer yet, let Examlex AI Copilot help.

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255