Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372 Exercise 96

Analyzing the Effects of Four Alternative Inventory Methods in a Periodic Inventory System

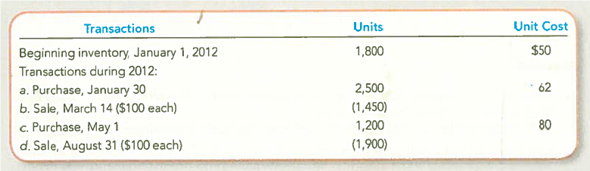

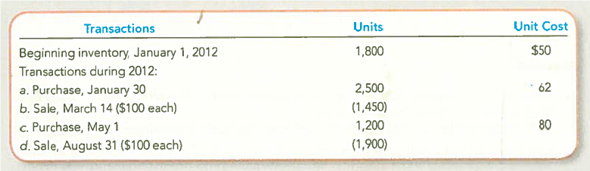

Gladstone Company tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31, 2012.

Required:

1. Compute the amount of goods available for sale, ending inventory, and cost of goods sold at December 31, 2012, under each of the following inventory costing methods:

a. Last-in, first-out.

b. Weighted average cost.

c. First-in, first-out.

d. Specific identification, assuming that the March 14, 2012, sale was selected two-fifths from the beginning inventory and three-fifths from the purchase of January 30, 2012. Assume that the sale of August 31, 2012, was selected from the remainder of the beginning inventory, with the balance from the purchase of May 1, 2012.

2. Of the four methods, which will result in the highest gross profit Which will result in the lowest income taxes

Gladstone Company tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31, 2012.

Required:

1. Compute the amount of goods available for sale, ending inventory, and cost of goods sold at December 31, 2012, under each of the following inventory costing methods:

a. Last-in, first-out.

b. Weighted average cost.

c. First-in, first-out.

d. Specific identification, assuming that the March 14, 2012, sale was selected two-fifths from the beginning inventory and three-fifths from the purchase of January 30, 2012. Assume that the sale of August 31, 2012, was selected from the remainder of the beginning inventory, with the balance from the purchase of May 1, 2012.

2. Of the four methods, which will result in the highest gross profit Which will result in the lowest income taxes

Explanation

1.

a.

The statement showing inventory co...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255