Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372 Exercise 31

Evaluating the Income Statement and Income Tax Effects of Lower of Cost or Market

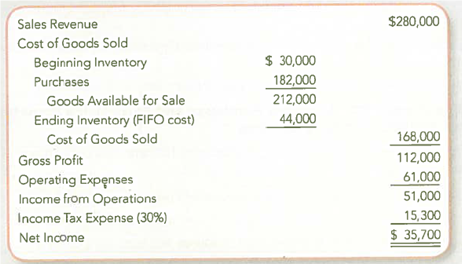

Smart Company prepared its annual financial statements dated December 31, 2013. The company used the FIFO inventory costing method, but it failed to apply LCM to the ending inventory. The preliminary 2013 income statement follows:

TIP: Inventory write-downs do not affect the cost of goods available for sale. Instead, the effect of the write-down is to reduce ending inventory, which increases Cost of Goods Sold and then affects other amounts reported lower in the income statement.

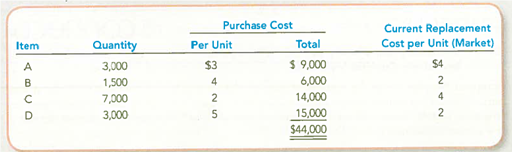

Assume that you have been asked to restate the 2013 financial statements to incorporate LCM. You have developed the following data relating to the 2013 ending inventory:

Required:

1. Restate the income statement to reflect LCM valuation of the 2013 ending inventory. Apply LCM on an item-by-item basis and show computations.

2. Compare and explain the LCM effect on each amount that was changed in requirement 1.

3. What is the conceptual basis for applying LCM to merchandise inventories

Smart Company prepared its annual financial statements dated December 31, 2013. The company used the FIFO inventory costing method, but it failed to apply LCM to the ending inventory. The preliminary 2013 income statement follows:

TIP: Inventory write-downs do not affect the cost of goods available for sale. Instead, the effect of the write-down is to reduce ending inventory, which increases Cost of Goods Sold and then affects other amounts reported lower in the income statement.

Assume that you have been asked to restate the 2013 financial statements to incorporate LCM. You have developed the following data relating to the 2013 ending inventory:

Required:

1. Restate the income statement to reflect LCM valuation of the 2013 ending inventory. Apply LCM on an item-by-item basis and show computations.

2. Compare and explain the LCM effect on each amount that was changed in requirement 1.

3. What is the conceptual basis for applying LCM to merchandise inventories

Explanation

1.

The following table shows the computa...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255