Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372 Exercise 27

Recording Accounts Receivable Transactions Using the Allowance Method

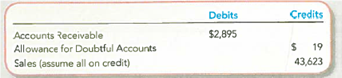

Intel Corporation is a well-known supplier of computer chips, boards, systems, and software building blocks. Assume the company recently reported the following amounts in its unadjusted trial balance at its year-end of December 25, 2010 (all amounts in millions):

Required:

1. Assume Intel uses ¼ of 1 percent of sales to estimate its Bad Debt Expense for the year. Prepare the adjusting journal entry required for the year, assuming no Bad Debt Expense has been recorded yet.

2. Assume instead that Intel uses the aging of accounts receivable method and estimates that $40 of its Accounts Receivable will be uncollectible. Prepare the adjusting journal entry required at December 25, 2010, for recording Bad Debt Expense.

3. Repeat requirement 2, except this time assume the unadjusted balance in Intel's Allowance for Doubtful Accounts at December 25, 2010, was a debit balance of $20.

4. If one of Intel's main customers declared bankruptcy in 2011, what journal entry would be used to write off its $15 balance

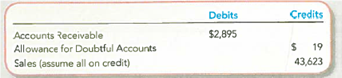

Intel Corporation is a well-known supplier of computer chips, boards, systems, and software building blocks. Assume the company recently reported the following amounts in its unadjusted trial balance at its year-end of December 25, 2010 (all amounts in millions):

Required:

1. Assume Intel uses ¼ of 1 percent of sales to estimate its Bad Debt Expense for the year. Prepare the adjusting journal entry required for the year, assuming no Bad Debt Expense has been recorded yet.

2. Assume instead that Intel uses the aging of accounts receivable method and estimates that $40 of its Accounts Receivable will be uncollectible. Prepare the adjusting journal entry required at December 25, 2010, for recording Bad Debt Expense.

3. Repeat requirement 2, except this time assume the unadjusted balance in Intel's Allowance for Doubtful Accounts at December 25, 2010, was a debit balance of $20.

4. If one of Intel's main customers declared bankruptcy in 2011, what journal entry would be used to write off its $15 balance

Explanation

Bad debts are the estimated amount of th...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255