Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372 Exercise 39

Computing Acquisition Cost and Recording Depreciation under Three Alternative Methods

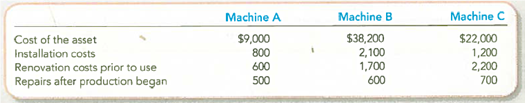

At the beginning of the year, Grillo Industries bought three used machines from Freeman Incorporated. The machines immediately were overhauled, installed, and started operating. Because the machines were different, each was recorded separately in the accounts.

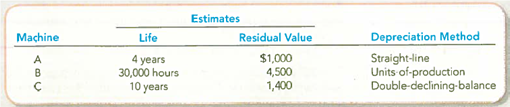

By the end of the first year, each machine had been operating 8,000 hours.

Required:

1. Compute the cost of each machine. Explain the rationale for capitalizing or expensing the various costs.

2. Give the journal entry to record depreciation expense at the end of year 1, assuming the following:

At the beginning of the year, Grillo Industries bought three used machines from Freeman Incorporated. The machines immediately were overhauled, installed, and started operating. Because the machines were different, each was recorded separately in the accounts.

By the end of the first year, each machine had been operating 8,000 hours.

Required:

1. Compute the cost of each machine. Explain the rationale for capitalizing or expensing the various costs.

2. Give the journal entry to record depreciation expense at the end of year 1, assuming the following:

Explanation

(1) Compute the cost of each machine:

T...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255