Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372 Exercise 65

Recording Straight-Line Depreciation and Repairs

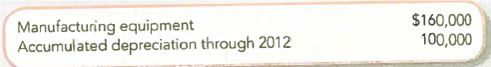

Winter Company operates a small manufacturing facility. On January 1, 2013, an asset account for the company showed the following balances:

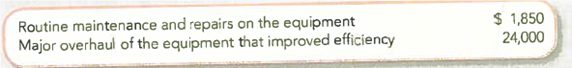

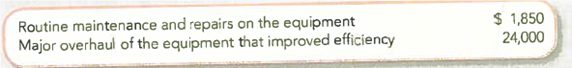

During the first week of January 2013, the following expenditures were incurred for repairs and maintenance:

The equipment is being depreciated on a straight-line basis over an estimated life of 15 years with a $10,000 estimated residual value. The annual accounting period ends on December 31.

Required:

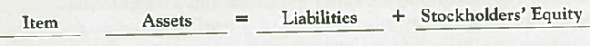

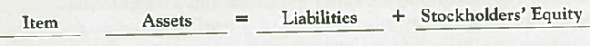

Indicate the effects (accounts, amounts, and + or -) of the following two items on the accounting equation, using the headings shown below.

1. The adjustment for depreciation made at the end of 2012.

2. The two expenditures for repairs and maintenance during January 2013.

Winter Company operates a small manufacturing facility. On January 1, 2013, an asset account for the company showed the following balances:

During the first week of January 2013, the following expenditures were incurred for repairs and maintenance:

The equipment is being depreciated on a straight-line basis over an estimated life of 15 years with a $10,000 estimated residual value. The annual accounting period ends on December 31.

Required:

Indicate the effects (accounts, amounts, and + or -) of the following two items on the accounting equation, using the headings shown below.

1. The adjustment for depreciation made at the end of 2012.

2. The two expenditures for repairs and maintenance during January 2013.

Explanation

(1) Indicate the effects of th...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255