Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372 Exercise 24

Preparing a Statement of Cash Flows (Indirect Method)

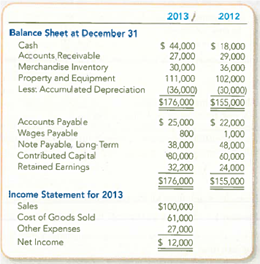

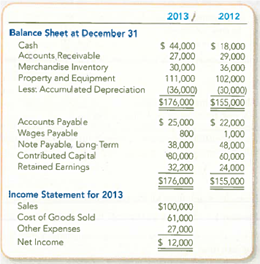

Hunter Company is developing its annual financial statements at December 31, 2013. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income statement are summarized:

Additional Data:

a. Bought equipment for cash, $9,000.

b. Paid $10,000 on the long-term note payable.

c. Issued new shares of stock for $20,000 cash.

d. Declared and paid a $3,800 cash dividend.

e. Other expenses included depreciation, $6,000; wages, $10,000; taxes, $3,000; other, $8,000.

f. Accounts Payable includes only inventory purchases made on credit. Because there are no liability accounts relating to taxes or other expenses, assume that these expenses were fully paid in cash.

Required:

1. Prepare the statement of cash flows for the year ended December 31, 2013, using the indirect method.

2. Use the statement of cash flows to evaluate Hunter's cash flows.

TIP; The demonstration cases provide good examples of information to consider when evaluating cash flows.

Hunter Company is developing its annual financial statements at December 31, 2013. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income statement are summarized:

Additional Data:

a. Bought equipment for cash, $9,000.

b. Paid $10,000 on the long-term note payable.

c. Issued new shares of stock for $20,000 cash.

d. Declared and paid a $3,800 cash dividend.

e. Other expenses included depreciation, $6,000; wages, $10,000; taxes, $3,000; other, $8,000.

f. Accounts Payable includes only inventory purchases made on credit. Because there are no liability accounts relating to taxes or other expenses, assume that these expenses were fully paid in cash.

Required:

1. Prepare the statement of cash flows for the year ended December 31, 2013, using the indirect method.

2. Use the statement of cash flows to evaluate Hunter's cash flows.

TIP; The demonstration cases provide good examples of information to consider when evaluating cash flows.

Explanation

1.

The required cash flow statement is g...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255