Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372 Exercise 72

Preparing and Interpreting a Statement of Cash Flows (Indirect Method)

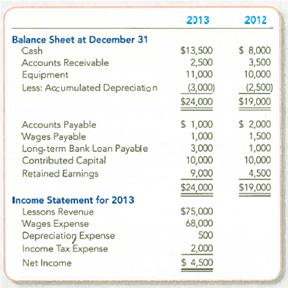

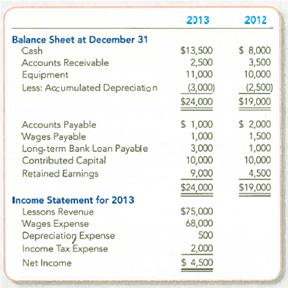

Soft Touch Company was started several years ago by two golf instructors. The company's comparative balance sheets and income statement are presented below, along with additional information.

Additional Data:

a. Bought new golf clubs using cash, $1,000.

b. Borrowed $2,000 cash from the bank during the year.

c. Accounts Payable includes only purchases of services made on credit for operating purposes. Because there are no liability accounts relating to income tax, assume that Income Tax Expense was fully paid in cash.

Required:

1. Prepare the statement of cash flows for the year ended December 31, 2013, using the indirect method.

2. Use the statement of cash flows to evaluate the company's cash flows.

TIP: The demonstration cases provide good examples of information to consider when evaluating cash flows.

Soft Touch Company was started several years ago by two golf instructors. The company's comparative balance sheets and income statement are presented below, along with additional information.

Additional Data:

a. Bought new golf clubs using cash, $1,000.

b. Borrowed $2,000 cash from the bank during the year.

c. Accounts Payable includes only purchases of services made on credit for operating purposes. Because there are no liability accounts relating to income tax, assume that Income Tax Expense was fully paid in cash.

Required:

1. Prepare the statement of cash flows for the year ended December 31, 2013, using the indirect method.

2. Use the statement of cash flows to evaluate the company's cash flows.

TIP: The demonstration cases provide good examples of information to consider when evaluating cash flows.

Explanation

1.

The required cash flow statement is g...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255