Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372 Exercise 26

(Supplement 12A) Preparing and Interpreting a Statement of Cash Flows with Loss on Disposal (Indirect Method)

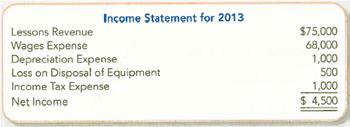

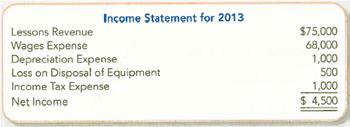

Assume the same facts as CP12-4, except for additional data item ( a ) and the income statement. Instead of item ( a ) from CP12-4, assume that the company bought new golf clubs for $3,000 cash and sold existing clubs for $1,000 cash. The clubs that were sold cost $2,000 and had Accumulated Depreciation of $500 at the time of sale. The income statement follows.

Required:

1. Prepare the statement of cash flows for the year ended December 31, 2013, using the indirect method.

2. Use the statement of cash flows to evaluate the company's cash flows.

Assume the same facts as CP12-4, except for additional data item ( a ) and the income statement. Instead of item ( a ) from CP12-4, assume that the company bought new golf clubs for $3,000 cash and sold existing clubs for $1,000 cash. The clubs that were sold cost $2,000 and had Accumulated Depreciation of $500 at the time of sale. The income statement follows.

Required:

1. Prepare the statement of cash flows for the year ended December 31, 2013, using the indirect method.

2. Use the statement of cash flows to evaluate the company's cash flows.

Explanation

1.

The required cash flow statement is g...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255