Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372 Exercise 32

Preparing and Evaluating a Simple Statement of Cash Flows (Indirect Method)

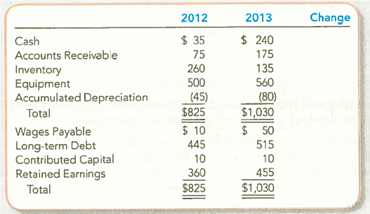

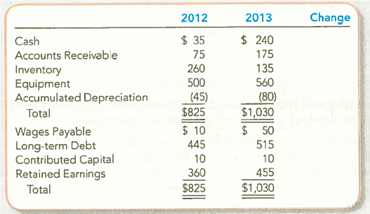

Suppose the income statement for Goggle Company reports $95 of net income, after deducting depreciation of $35. The company bought equipment costing $60 and obtained a long-term bank loan for $70. The company's comparative balance sheet, at December 31, is presented on the following page.

Required:

1. Calculate the change in each balance sheet account, and indicate whether each account relates to operating, investing, and/or financing activities.

2. Prepare a statement of cash flows using the indirect method.

3. In one sentence, explain why an increase in accounts receivable is subtracted.

4. In one sentence, explain why a decrease in inventory is added.

5. In one sentence, explain why an increase in wages payable is added.

6. Are the cash flows typical of a start-up, healthy, or troubled company Explain.

Suppose the income statement for Goggle Company reports $95 of net income, after deducting depreciation of $35. The company bought equipment costing $60 and obtained a long-term bank loan for $70. The company's comparative balance sheet, at December 31, is presented on the following page.

Required:

1. Calculate the change in each balance sheet account, and indicate whether each account relates to operating, investing, and/or financing activities.

2. Prepare a statement of cash flows using the indirect method.

3. In one sentence, explain why an increase in accounts receivable is subtracted.

4. In one sentence, explain why a decrease in inventory is added.

5. In one sentence, explain why an increase in wages payable is added.

6. Are the cash flows typical of a start-up, healthy, or troubled company Explain.

Explanation

1.

The change in each balance sheet acco...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255