Cornerstones of Managerial Accounting 4th Edition by Maryanne Mowen, Don Hansen, Dan Heitger

Edition 4ISBN: 978-0324380767

Cornerstones of Managerial Accounting 4th Edition by Maryanne Mowen, Don Hansen, Dan Heitger

Edition 4ISBN: 978-0324380767 Exercise 49

Calculating the Predetermined Overhead Rate, Applying Overhead to Production, Reconciling Overhead at the End of the Year, Adjusting Cost of Goods Sold for Under- and Overapplied Overhead

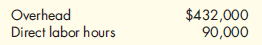

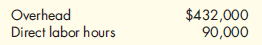

At the beginning of the year, Gaudi Company estimated the following:

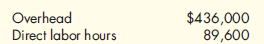

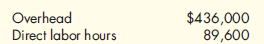

Gaudi uses normal costing and applies overhead on the basis of direct labor hours. For the month of January, direct labor hours were 7,650. By the end of the year, Gaudi showed the following actual amounts:

Assume that unadjusted Cost of Goods Sold for Gaudi was $707,000.

Required:

1. Calculate the predetermined overhead rate for Gaudi.

2. Calculate the overhead applied to production in January.

3. Calculate the total applied overhead for the year. Was overhead over- or underapplied By how much

4. Calculate adjusted Cost of Goods Sold after adjusting for the overhead variance.

At the beginning of the year, Gaudi Company estimated the following:

Gaudi uses normal costing and applies overhead on the basis of direct labor hours. For the month of January, direct labor hours were 7,650. By the end of the year, Gaudi showed the following actual amounts:

Assume that unadjusted Cost of Goods Sold for Gaudi was $707,000.

Required:

1. Calculate the predetermined overhead rate for Gaudi.

2. Calculate the overhead applied to production in January.

3. Calculate the total applied overhead for the year. Was overhead over- or underapplied By how much

4. Calculate adjusted Cost of Goods Sold after adjusting for the overhead variance.

Explanation

1. Calculate predetermined overhead rate...

Cornerstones of Managerial Accounting 4th Edition by Maryanne Mowen, Don Hansen, Dan Heitger

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255