Cornerstones of Managerial Accounting 4th Edition by Maryanne Mowen, Don Hansen, Dan Heitger

Edition 4ISBN: 978-0324380767

Cornerstones of Managerial Accounting 4th Edition by Maryanne Mowen, Don Hansen, Dan Heitger

Edition 4ISBN: 978-0324380767 Exercise 4

Job-Order Cost Sheets, Balance in Work in Process and Finished Goods

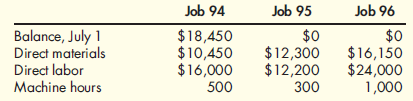

Schulberg Company, a job-order costing firm, worked on three jobs in July. Data are as follows:

Overhead is applied to jobs at the rate of $20 per machine hour. By July 31, Jobs 94 and 96 were completed. Jobs 90 and 94 were sold. Job 95 remained in process. On July 1, the balance in Finished Goods was $49,000 (consisting of Job 90 for $25,600 and Job 92 for $23,400).

Schulberg prices its jobs at cost plus 20 percent. During July, variable marketing expenses were 5 percent of sales, and fixed marketing expenses were $2,000; administrative expenses were $4,800.

Required:

1. Prepare job-order cost sheets for all jobs in process during July, showing all costs through July 31.

2. Calculate the balance in Work in Process on July 31.

3. Calculate the balance in Finished Goods on July 31.

4. Calculate Cost of Goods Sold for July.

5. Calculate operating income for Schulberg Company for the month of July.

Schulberg Company, a job-order costing firm, worked on three jobs in July. Data are as follows:

Overhead is applied to jobs at the rate of $20 per machine hour. By July 31, Jobs 94 and 96 were completed. Jobs 90 and 94 were sold. Job 95 remained in process. On July 1, the balance in Finished Goods was $49,000 (consisting of Job 90 for $25,600 and Job 92 for $23,400).

Schulberg prices its jobs at cost plus 20 percent. During July, variable marketing expenses were 5 percent of sales, and fixed marketing expenses were $2,000; administrative expenses were $4,800.

Required:

1. Prepare job-order cost sheets for all jobs in process during July, showing all costs through July 31.

2. Calculate the balance in Work in Process on July 31.

3. Calculate the balance in Finished Goods on July 31.

4. Calculate Cost of Goods Sold for July.

5. Calculate operating income for Schulberg Company for the month of July.

Explanation

1. Job-order cost sheet: 2. Since job 9...

Cornerstones of Managerial Accounting 4th Edition by Maryanne Mowen, Don Hansen, Dan Heitger

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255