Contemporary Mathematics for Business & Consumers 8th Edition by Robert Brechner,Geroge Bergeman

Edition 8ISBN: 978-1305585454

Contemporary Mathematics for Business & Consumers 8th Edition by Robert Brechner,Geroge Bergeman

Edition 8ISBN: 978-1305585454 Exercise 5

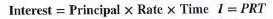

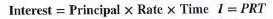

Sometimes banks offer checking accounts that earn interest on the average daily balance of the account each month. This interest is calculated using a formula known as the simple interest formula. The formulais written as:

The formula states that the amount of interest earned on the account is equal to the principal (average daily balance) multiplied by the rate (interest rate per year - expressed as a decimal) multiplied by the time (expressed in years - use

to represent one month of a year).

to represent one month of a year).

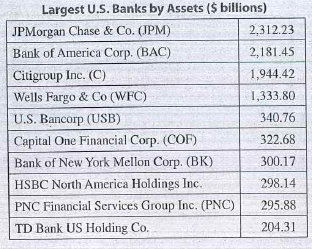

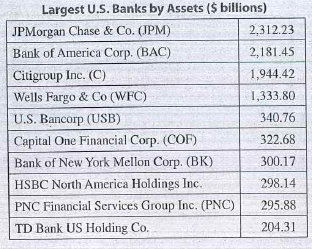

a. If you have not already done so, complete the Business Decision, Choosing a Bank on page 112.

b. Use the simple interest formula to calculate the amount of interest you would earn per month if the Intercontinental Bank was offering 1.5% (.015) interest per year on checking accounts. (Note that your average daily balance changes from $900 to $2,400 in the last six months of the year.) Round monthly amounts to the nearest cent when necessary. How much interest would you earn fir the year

c. How much interest would you earn per month at Bank of America if it were offering 1% (0.1)

d. Recalculate the cost of doing business with Intercontinental Bank and Bank of America for a year

e. Based on this new information, which of the four banks should you choose for your checking account

The formula states that the amount of interest earned on the account is equal to the principal (average daily balance) multiplied by the rate (interest rate per year - expressed as a decimal) multiplied by the time (expressed in years - use

to represent one month of a year).

to represent one month of a year).a. If you have not already done so, complete the Business Decision, Choosing a Bank on page 112.

b. Use the simple interest formula to calculate the amount of interest you would earn per month if the Intercontinental Bank was offering 1.5% (.015) interest per year on checking accounts. (Note that your average daily balance changes from $900 to $2,400 in the last six months of the year.) Round monthly amounts to the nearest cent when necessary. How much interest would you earn fir the year

c. How much interest would you earn per month at Bank of America if it were offering 1% (0.1)

d. Recalculate the cost of doing business with Intercontinental Bank and Bank of America for a year

e. Based on this new information, which of the four banks should you choose for your checking account

Explanation

This question doesn’t have an expert verified answer yet, let Examlex AI Copilot help.

Contemporary Mathematics for Business & Consumers 8th Edition by Robert Brechner,Geroge Bergeman

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255