M&B3 3rd Edition by Dean Croushore

Edition 3ISBN: 978-1285167961

M&B3 3rd Edition by Dean Croushore

Edition 3ISBN: 978-1285167961 Exercise 10

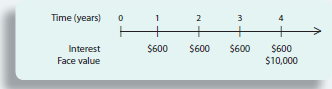

Suppose that you are considering the purchase of a security that has the following timeline of payments:

a How much would you be willing to pay for this security if the market interest rate is 6 percent

b Suppose that you have just purchased the security, and suddenly the market interest rate falls to 5 percent. What is the security worth

c Suppose that one year has elapsed, you have received the fi rst payment of $600, and the market interest rate is still 5 percent. How much would another investor be willing to pay for your security

d Suppose that two years have elapsed since you purchased the security, and you have received the fi rst two payments of $600 each. Now suppose that the market interest rate suddenly jumps to 10 percent. How much would another investor be willing to pay for your security

a How much would you be willing to pay for this security if the market interest rate is 6 percent

b Suppose that you have just purchased the security, and suddenly the market interest rate falls to 5 percent. What is the security worth

c Suppose that one year has elapsed, you have received the fi rst payment of $600, and the market interest rate is still 5 percent. How much would another investor be willing to pay for your security

d Suppose that two years have elapsed since you purchased the security, and you have received the fi rst two payments of $600 each. Now suppose that the market interest rate suddenly jumps to 10 percent. How much would another investor be willing to pay for your security

Explanation

This question doesn’t have an expert verified answer yet, let Examlex AI Copilot help.

M&B3 3rd Edition by Dean Croushore

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255