Microeconomics 6th Edition by Robert Hall, Shirley Kuiper, Marc Lieberman

Edition 6ISBN: 978-1133708735

Microeconomics 6th Edition by Robert Hall, Shirley Kuiper, Marc Lieberman

Edition 6ISBN: 978-1133708735 Exercise 9

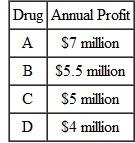

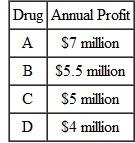

A drug manufacturer is considering how many of four new drugs to develop. Suppose it takes one year and $10 million to develop a new drug,with the entire cost being paid up front (immediately). The yearly profits from the new drugs will begin in the second year (with profits,as always,assumed to come at the end of the year)and are given in the table below:

These profits,which are certain,accrue only while the drug is protected by a patent; once the patent runs out,profit is zero.

These profits,which are certain,accrue only while the drug is protected by a patent; once the patent runs out,profit is zero.

a. If the annual interest rate is 10 percent and patents are granted for just two years,which drugs should be developed?

b. If the annual interest rate is 10 percent and patents are granted for three years,which drugs should be developed?

c. Answer (a)and (b)again,this time assuming the discount rate is 5 percent.

d. Based on your answers above,what is the relationship between new drug development and (1)the discount rate; (2)the duration of patent protection?

e. Would the relationships in (d)still hold in the more realistic case where profits from new drugs are uncertain?

f. Is there any downside to a change in patent duration designed to speed the development of new drugs? Explain briefly.

These profits,which are certain,accrue only while the drug is protected by a patent; once the patent runs out,profit is zero.

These profits,which are certain,accrue only while the drug is protected by a patent; once the patent runs out,profit is zero.a. If the annual interest rate is 10 percent and patents are granted for just two years,which drugs should be developed?

b. If the annual interest rate is 10 percent and patents are granted for three years,which drugs should be developed?

c. Answer (a)and (b)again,this time assuming the discount rate is 5 percent.

d. Based on your answers above,what is the relationship between new drug development and (1)the discount rate; (2)the duration of patent protection?

e. Would the relationships in (d)still hold in the more realistic case where profits from new drugs are uncertain?

f. Is there any downside to a change in patent duration designed to speed the development of new drugs? Explain briefly.

Explanation

The project has an upfront cost of $10 m...

Microeconomics 6th Edition by Robert Hall, Shirley Kuiper, Marc Lieberman

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255