PFIN 5th Edition by Randall Billingsley,Lawrence Gitman,Michael Joehnk

Edition 5ISBN: 978-1305661707

PFIN 5th Edition by Randall Billingsley,Lawrence Gitman,Michael Joehnk

Edition 5ISBN: 978-1305661707 Exercise 4

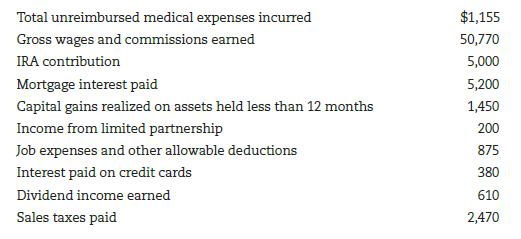

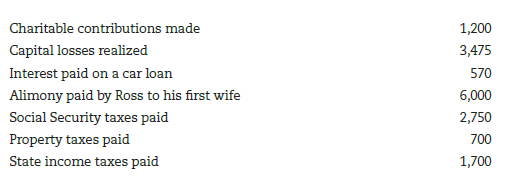

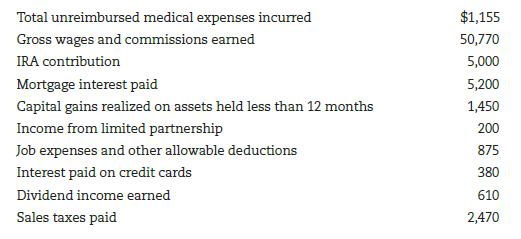

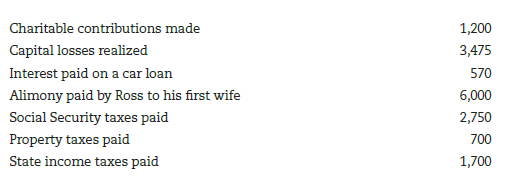

Calculating taxable income for a married couple filing jointly. Ross and april Whittaker are married and have one child. Ross is putting together some figures so that he can prepare the Whittakers' joint 2014 tax return. He can claim three personal exemptions (including himself). So far, he's been able to determine the following with regard to income and possible deductions:

Given this information, how much taxable income will the Whittakers have in 2014? ( Note: Assume that Ross is covered by a pension plan where he works, the standard deduction of $12,400 for married filing jointly applies, and each exemption claimed is worth $3,950.)

Given this information, how much taxable income will the Whittakers have in 2014? ( Note: Assume that Ross is covered by a pension plan where he works, the standard deduction of $12,400 for married filing jointly applies, and each exemption claimed is worth $3,950.)

Explanation

The status of tax payer is married coupl...

PFIN 5th Edition by Randall Billingsley,Lawrence Gitman,Michael Joehnk

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255