PFIN 5th Edition by Randall Billingsley,Lawrence Gitman,Michael Joehnk

Edition 5ISBN: 978-1305661707

PFIN 5th Edition by Randall Billingsley,Lawrence Gitman,Michael Joehnk

Edition 5ISBN: 978-1305661707 Exercise 3

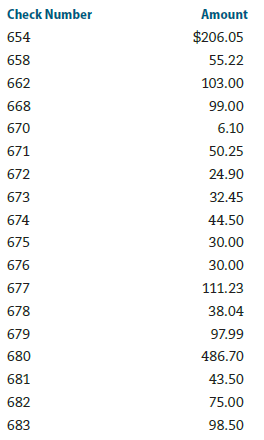

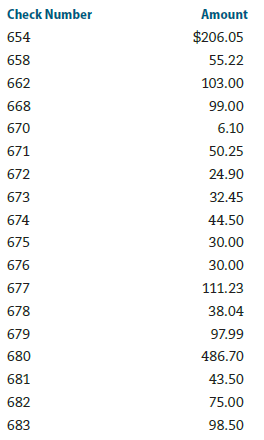

Checking account reconciliation. Use Worksheet 4.1. Emilio Valadez has a an interest-paying (NOW) checking account at the Second State Bank. His checkbook ledger lists the following checks:

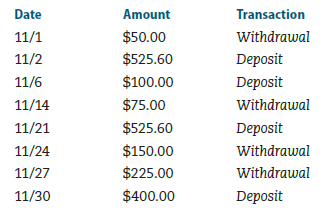

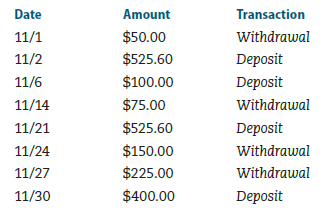

Emilio also made the following withdrawals and deposits at an ATM near his home:

Emilio's checkbook ledger shows an ending balance of $286.54. He has just received his bank statement for the month of November. It shows an ending balance of $622.44; it also shows that he earned interest for November of $3.28, had a check service charge of $8 for the month, and had another $20 charge for a returned check. His bank statement indicates the following checks have cleared: 654, 662, 672, 674, 675, 676, 677, 678, 679, and 681. ATM withdrawals on 11/1 and 11/14 and deposits on 11/2 and 11/6 have cleared; no other checks or ATM activities are listed on his statement, so anything remaining should be treated as outstanding. Use a checking account reconciliation form like the one in Worksheet 4.1 to reconcile Emilio's checking account.

Emilio also made the following withdrawals and deposits at an ATM near his home:

Emilio's checkbook ledger shows an ending balance of $286.54. He has just received his bank statement for the month of November. It shows an ending balance of $622.44; it also shows that he earned interest for November of $3.28, had a check service charge of $8 for the month, and had another $20 charge for a returned check. His bank statement indicates the following checks have cleared: 654, 662, 672, 674, 675, 676, 677, 678, 679, and 681. ATM withdrawals on 11/1 and 11/14 and deposits on 11/2 and 11/6 have cleared; no other checks or ATM activities are listed on his statement, so anything remaining should be treated as outstanding. Use a checking account reconciliation form like the one in Worksheet 4.1 to reconcile Emilio's checking account.

Explanation

Checking account reconciliation:

A reco...

PFIN 5th Edition by Randall Billingsley,Lawrence Gitman,Michael Joehnk

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255