Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 35

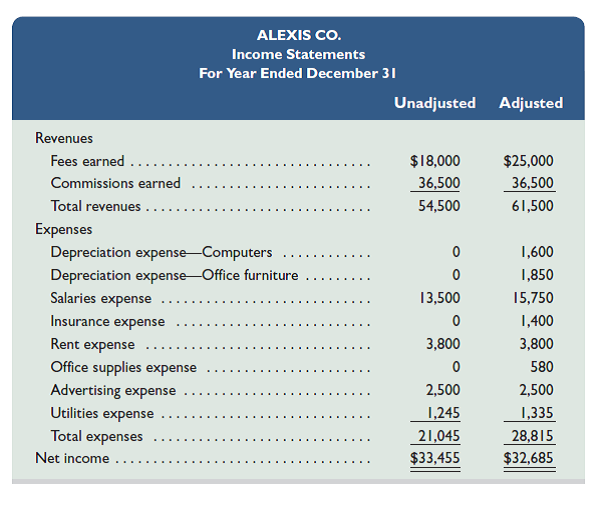

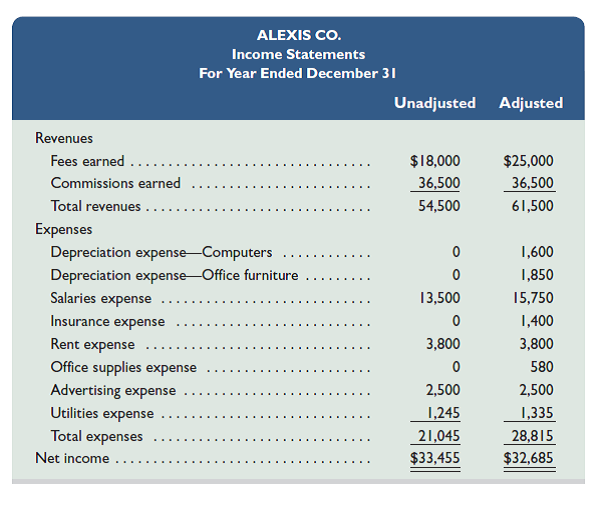

Following are two income statements for Alexis Co. for the year ended December 31. The left column is prepared before any adjusting entries are recorded, and the right column includes the effects of adjusting entries. The company records cash receipts and payments related to unearned and prepaid items in balance sheet accounts. Analyze the statements and prepare the eight adjusting entries that likely were recorded. ( Note: 30% of the $7,000 adjustment for Fees Earned has been earned but not billed, and the other 70% has been earned by performing services that were paid for in advance.)

Explanation

1.

The balance of fees earned revenue ha...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255