Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 52

Refer to the information in Exercise 6-3 and assume the periodic inventory system is used. Determine the costs assigned to ending inventory and to cost of goods sold using ( a ) specific identification, ( b ) weighted average, ( c ) FIFO, and ( d ) LIFO. (Round per unit costs and inventory amounts to cents.)

Reference: Exercise 6-3

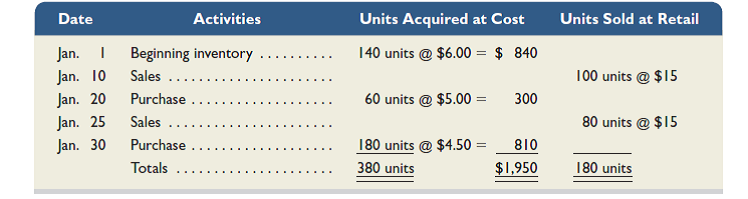

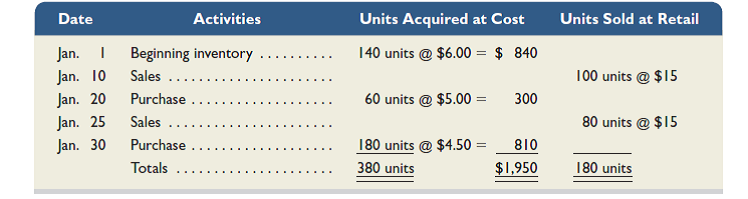

Laker Company reported the following January purchases and sales data for its only product.

Required

The company uses a perpetual inventory system. Determine the cost assigned to ending inventory and to cost of goods sold using ( a ) specific identification, ( b ) weighted average, ( c ) FIFO, and ( d ) LIFO. (Round per unit costs and inventory amounts to cents.) For specific identification, ending inventory consists of 200 units, where 180 are from the January 30 purchase, 5 are from the January 20 purchase, and 15 are from beginning inventory.

Reference: Exercise 6-3

Laker Company reported the following January purchases and sales data for its only product.

Required

The company uses a perpetual inventory system. Determine the cost assigned to ending inventory and to cost of goods sold using ( a ) specific identification, ( b ) weighted average, ( c ) FIFO, and ( d ) LIFO. (Round per unit costs and inventory amounts to cents.) For specific identification, ending inventory consists of 200 units, where 180 are from the January 30 purchase, 5 are from the January 20 purchase, and 15 are from beginning inventory.

Explanation

Assuming periodic inventory system is ad...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255