Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 1

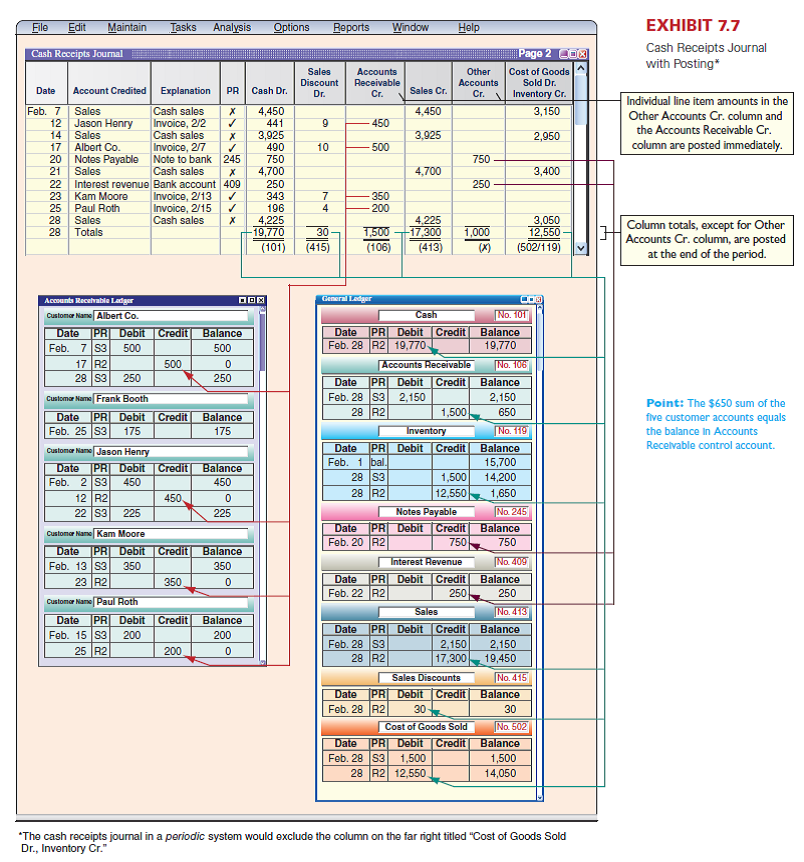

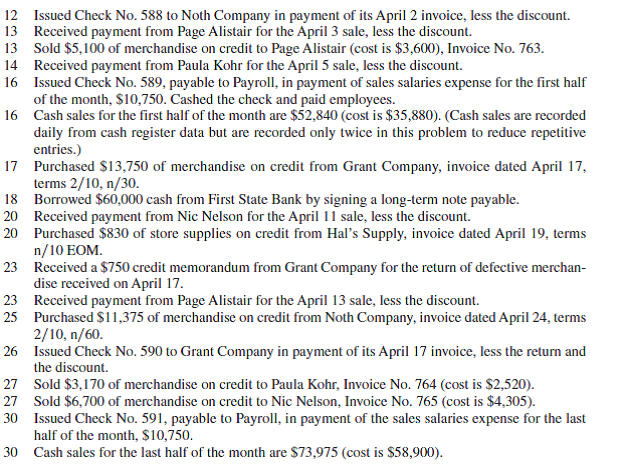

Wiset Company completes these transactions during April of the current year (the terms of all its credit sales are 2/10, n/30).

Apr. 2 Purchased $14,300 of merchandise on credit from Noth Company, invoice dated April 2, terms 2/10, n/60.

3 Sold merchandise on credit to Page Alistair, Invoice No. 760, for $4,000 (cost is $3,000).

3 Purchased $1,480 of office supplies on credit from Custer, Inc. Invoice dated April 2, terms n/10 EOM.

4 Issued Check No. 587 to World View for advertising expense, $899.

5 Sold merchandise on credit to Paula Kohr, Invoice No. 761, for $8,000 (cost is $6,500).

6 Received an $80 credit memorandum from Custer, Inc., for the return of some of the office supplies received on April 3.

9 Purchased $12,125 of store equipment on credit from Hal's Supply, invoice dated April 9, terms n/10 EOM.

11 Sold merchandise on credit to Nic Nelson, Invoice No. 762, for $10,500 (cost is $7,000).

Required

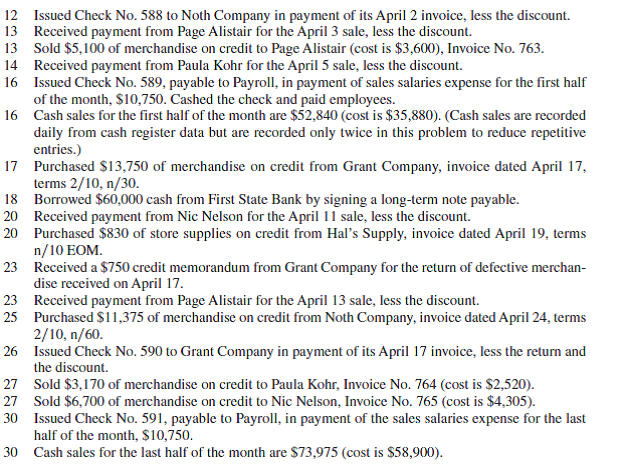

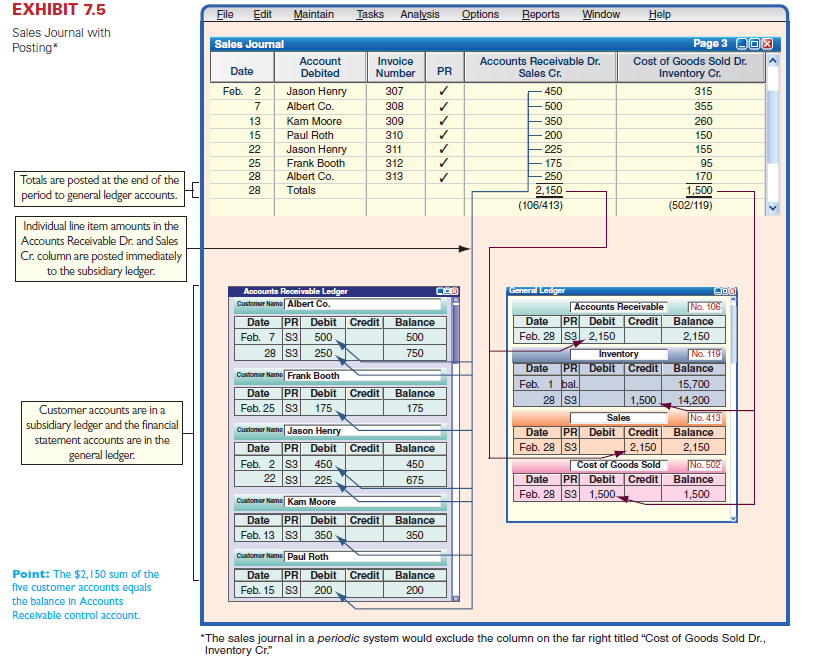

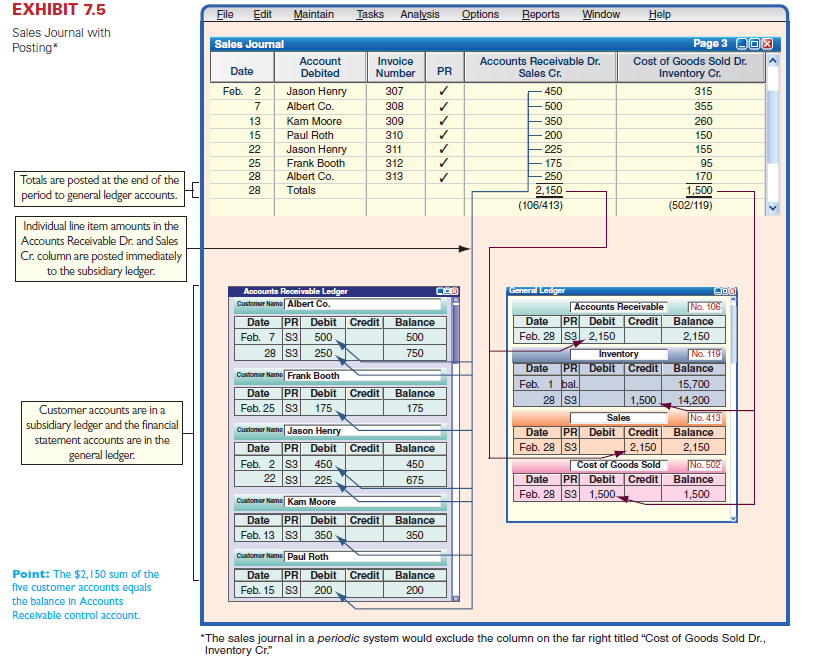

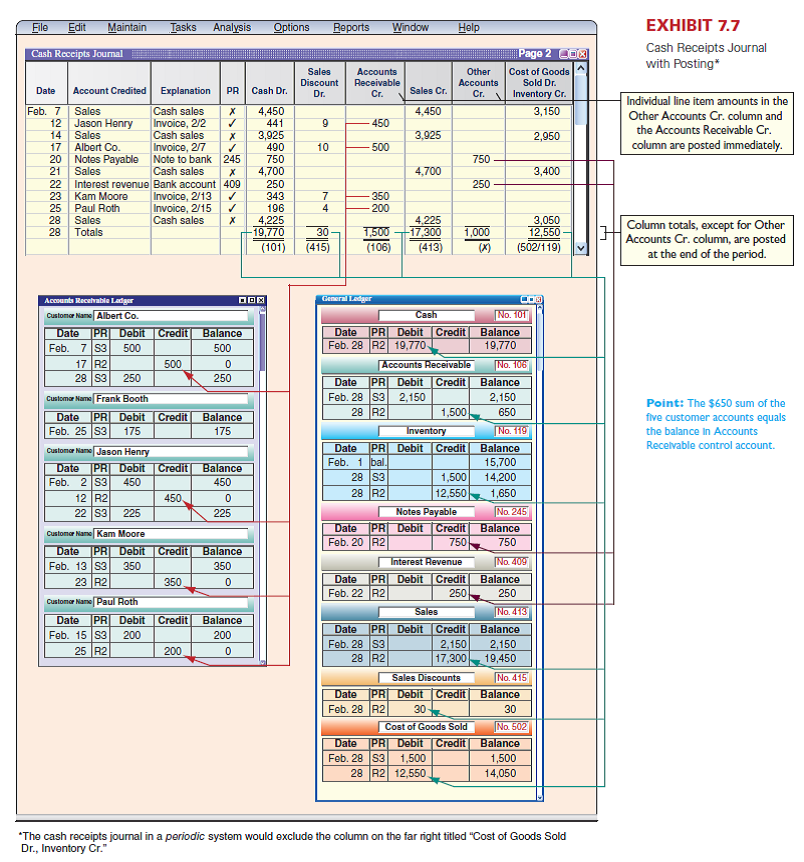

1. Prepare a sales journal like that in Exhibit 7.5 and a cash receipts journal like that in Exhibit 7.7. Number both journal pages as page 3. Then review the transactions of Wiset Company and enter those that should be journalized in the sales journal and those that should be journalized in the cash receipts journal. Ignore any transactions that should be journalized in a purchases journal, a cash disbursements journal, or a general journal.

2. Open the following general ledger accounts: Cash; Accounts Receivable; Inventory; Long-Term Notes Payable; B. Wiset, Capital; Sales; Sales Discounts; and Cost of Goods Sold. Enter the March 31 balances for Cash ($85,000), Inventory ($125,000), Long-Term Notes Payable ($110,000), and B. Wiset, Capital ($100,000). Also open accounts receivable subsidiary ledger accounts for Paula Kohr, Page Alistair, and Nic Nelson.

3. Verify that amounts that should be posted as individual amounts from the journals have been posted. (Such items are immediately posted.) Foot and crossfoot the journals and make the month-end postings.

4. Prepare a trial balance of the general ledger accounts opened as required for part 2; then prove the accuracy of the subsidiary ledger by preparing a schedule of accounts receivable.

Analysis Component

5. Assume that the total for the schedule of accounts receivable does not equal the balance of the controlling account in the general ledger. Describe steps you would take to discover the error(s).

Reference: Exhibit 7.5

Exhibit 7.7

Apr. 2 Purchased $14,300 of merchandise on credit from Noth Company, invoice dated April 2, terms 2/10, n/60.

3 Sold merchandise on credit to Page Alistair, Invoice No. 760, for $4,000 (cost is $3,000).

3 Purchased $1,480 of office supplies on credit from Custer, Inc. Invoice dated April 2, terms n/10 EOM.

4 Issued Check No. 587 to World View for advertising expense, $899.

5 Sold merchandise on credit to Paula Kohr, Invoice No. 761, for $8,000 (cost is $6,500).

6 Received an $80 credit memorandum from Custer, Inc., for the return of some of the office supplies received on April 3.

9 Purchased $12,125 of store equipment on credit from Hal's Supply, invoice dated April 9, terms n/10 EOM.

11 Sold merchandise on credit to Nic Nelson, Invoice No. 762, for $10,500 (cost is $7,000).

Required

1. Prepare a sales journal like that in Exhibit 7.5 and a cash receipts journal like that in Exhibit 7.7. Number both journal pages as page 3. Then review the transactions of Wiset Company and enter those that should be journalized in the sales journal and those that should be journalized in the cash receipts journal. Ignore any transactions that should be journalized in a purchases journal, a cash disbursements journal, or a general journal.

2. Open the following general ledger accounts: Cash; Accounts Receivable; Inventory; Long-Term Notes Payable; B. Wiset, Capital; Sales; Sales Discounts; and Cost of Goods Sold. Enter the March 31 balances for Cash ($85,000), Inventory ($125,000), Long-Term Notes Payable ($110,000), and B. Wiset, Capital ($100,000). Also open accounts receivable subsidiary ledger accounts for Paula Kohr, Page Alistair, and Nic Nelson.

3. Verify that amounts that should be posted as individual amounts from the journals have been posted. (Such items are immediately posted.) Foot and crossfoot the journals and make the month-end postings.

4. Prepare a trial balance of the general ledger accounts opened as required for part 2; then prove the accuracy of the subsidiary ledger by preparing a schedule of accounts receivable.

Analysis Component

5. Assume that the total for the schedule of accounts receivable does not equal the balance of the controlling account in the general ledger. Describe steps you would take to discover the error(s).

Reference: Exhibit 7.5

Exhibit 7.7

Explanation

Sales and Cash Receipts in a manual acco...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255