Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 23

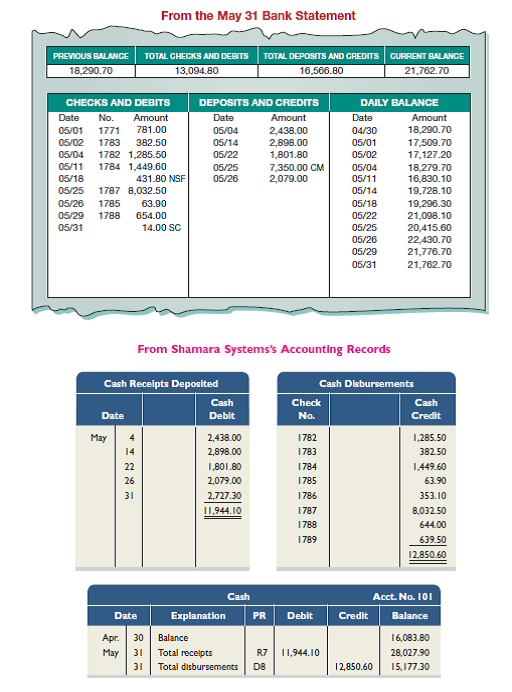

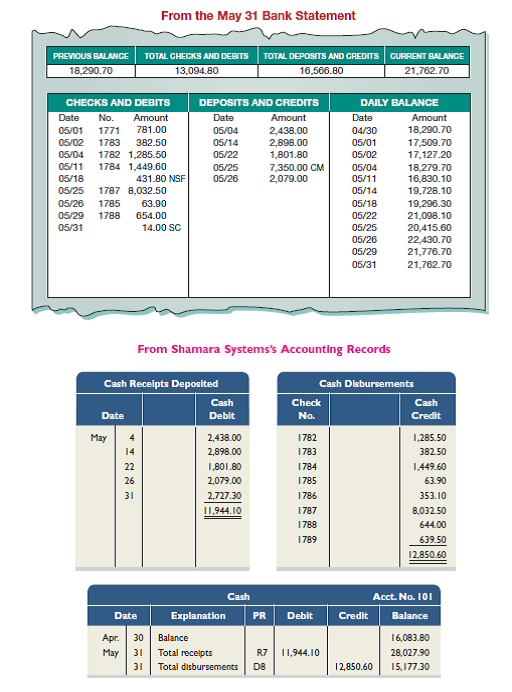

Shamara Systems most recently reconciled its bank balance on April 30 and reported two checks outstanding at that time, No. 1771 for $781 and No. 1780 for $1,425.90. The following information is available for its May 31, 2015, reconciliation.

Additional Information

Check No. 1788 is correctly drawn for $654 to pay for May utilities; however, the recordkeeper misread the amount and entered it in the accounting records with a debit to Utilities Expense and a credit to Cash for $644. The bank paid and deducted the correct amount. The NSF check shown in the statement was originally received from a customer, W. Sox, in payment of her account. The company has not yet recorded its return. The credit memorandum is from a $7,400 note that the bank collected for the company. The bank deducted a $50 collection fee and deposited the remainder in the company's account. The collection and fee have not yet been recorded.

Required

1. Prepare the May 31, 2015, bank reconciliation for Shamara Systems.

2. Prepare the journal entries (in dollars and cents) to adjust the book balance of cash to the reconciled balance.

Analysis Component

3. The bank statement reveals that some of the prenumbered checks in the sequence are missing. Describe three possible situations to explain this.

Additional Information

Check No. 1788 is correctly drawn for $654 to pay for May utilities; however, the recordkeeper misread the amount and entered it in the accounting records with a debit to Utilities Expense and a credit to Cash for $644. The bank paid and deducted the correct amount. The NSF check shown in the statement was originally received from a customer, W. Sox, in payment of her account. The company has not yet recorded its return. The credit memorandum is from a $7,400 note that the bank collected for the company. The bank deducted a $50 collection fee and deposited the remainder in the company's account. The collection and fee have not yet been recorded.

Required

1. Prepare the May 31, 2015, bank reconciliation for Shamara Systems.

2. Prepare the journal entries (in dollars and cents) to adjust the book balance of cash to the reconciled balance.

Analysis Component

3. The bank statement reveals that some of the prenumbered checks in the sequence are missing. Describe three possible situations to explain this.

Explanation

Bank reconciliation

Bank reconciliation...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255