Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 35

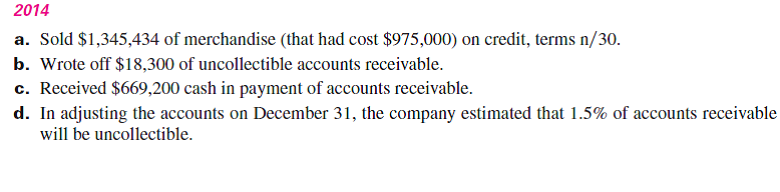

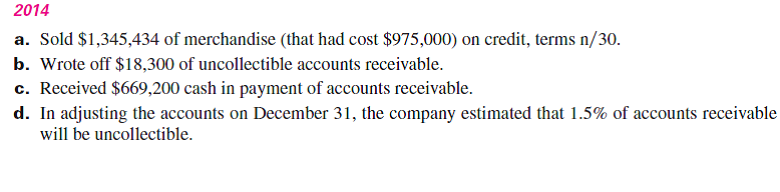

Liang Company began operations on January 1, 2014. During its first two years, the company completed a number of transactions involving sales on credit, accounts receivable collections, and bad debts. These transactions are summarized as follows:

2015

e. Sold $1,525,634 of merchandise (that had cost $1,250,000) on credit, terms n/30.

f. Wrote off $27,800 of uncollectible accounts receivable.

g. Received $1,204,600 cash in payment of accounts receivable.

h. In adjusting the accounts on December 31, the company estimated that 1.5% of accounts receivable will be uncollectible.

Required

Prepare journal entries to record Liang's 2014 and 2015 summarized transactions and its year-end adjustments to record bad debts expense. (The company uses the perpetual inventory system and it applies the allowance method for its accounts receivable. Round amounts to the nearest dollar.)

2015

e. Sold $1,525,634 of merchandise (that had cost $1,250,000) on credit, terms n/30.

f. Wrote off $27,800 of uncollectible accounts receivable.

g. Received $1,204,600 cash in payment of accounts receivable.

h. In adjusting the accounts on December 31, the company estimated that 1.5% of accounts receivable will be uncollectible.

Required

Prepare journal entries to record Liang's 2014 and 2015 summarized transactions and its year-end adjustments to record bad debts expense. (The company uses the perpetual inventory system and it applies the allowance method for its accounts receivable. Round amounts to the nearest dollar.)

Explanation

Bad debts refer to debt which cannot be ...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255