Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 63

Using the data in situation a of Exercise 11-5, prepare the employer's September 30 journal entries to record the employer's payroll taxes expense and its related liabilities. (Round amounts to cents.)

Reference: Exercise 11-5

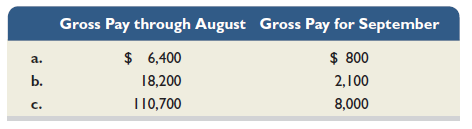

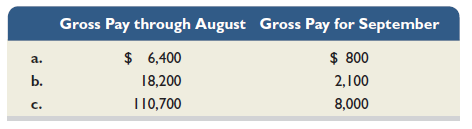

BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $117,000 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 2.9% of the first $7,000 paid to its employee. Compute BMX's amounts for each of these four taxes as applied to the employee's gross earnings for September under each of three separate situations ( a ), ( b ), and ( c ). (Round amounts to cents.)

Reference: Exercise 11-5

BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $117,000 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 2.9% of the first $7,000 paid to its employee. Compute BMX's amounts for each of these four taxes as applied to the employee's gross earnings for September under each of three separate situations ( a ), ( b ), and ( c ). (Round amounts to cents.)

Explanation

Employer Payroll taxes

Employer is liab...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255