Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 56

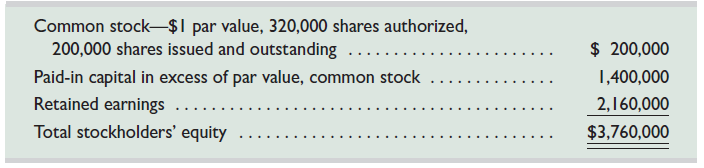

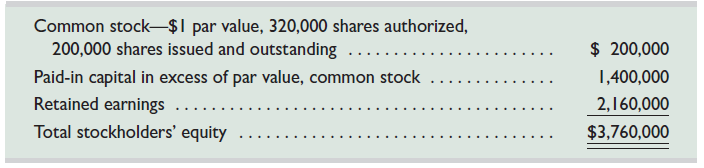

Balthus Corp. reports the following components of stockholders' equity on December 31, 2015:

It completed the following transactions related to stockholders' equity in year 2016:

Jan. 10 Purchased 40,000 shares of its own stock at $12 cash per share.

Mar. 2 Directors declared a $1.50 per share cash dividend payable on March 31 to the March 15 stockholders of record.

Mar. 31 Paid the dividend declared on March 2.

Nov. 11 Sold 24,000 of its treasury shares at $13 cash per share.

Nov. 25 Sold 16,000 of its treasury shares at $9.50 cash per share.

Dec. 1 Directors declared a $2.50 per share cash dividend payable on January 2 to the December 10 stockholders of record.

Dec. 31 Closed the $1,072,000 credit balance (from net income) in the Income Summary account to Retained Earnings.

Required

1. Prepare journal entries to record each of these transactions for 2016.

2. Prepare a statement of retained earnings for the year ended December 31, 2016.

3. Prepare the stockholders' equity section of the company's balance sheet as of December 31, 2016.

It completed the following transactions related to stockholders' equity in year 2016:

Jan. 10 Purchased 40,000 shares of its own stock at $12 cash per share.

Mar. 2 Directors declared a $1.50 per share cash dividend payable on March 31 to the March 15 stockholders of record.

Mar. 31 Paid the dividend declared on March 2.

Nov. 11 Sold 24,000 of its treasury shares at $13 cash per share.

Nov. 25 Sold 16,000 of its treasury shares at $9.50 cash per share.

Dec. 1 Directors declared a $2.50 per share cash dividend payable on January 2 to the December 10 stockholders of record.

Dec. 31 Closed the $1,072,000 credit balance (from net income) in the Income Summary account to Retained Earnings.

Required

1. Prepare journal entries to record each of these transactions for 2016.

2. Prepare a statement of retained earnings for the year ended December 31, 2016.

3. Prepare the stockholders' equity section of the company's balance sheet as of December 31, 2016.

Explanation

1.

On 10th January, 2016, common stock ...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255