Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 79

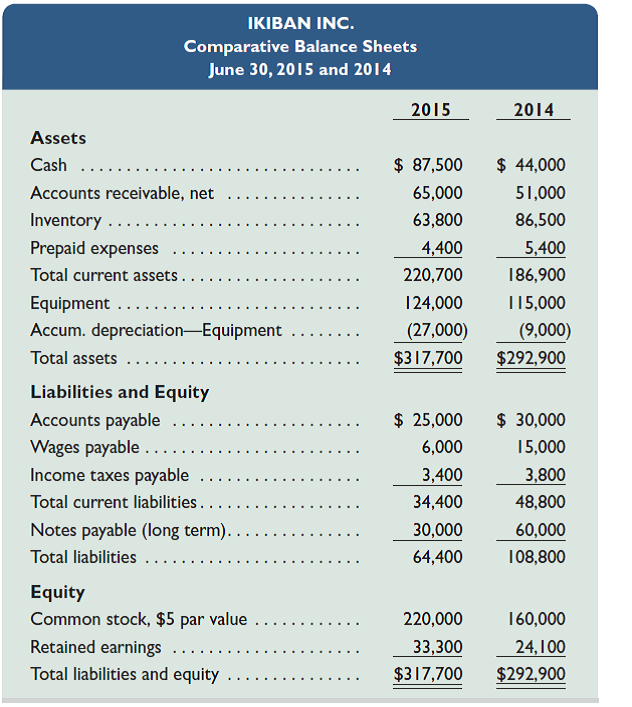

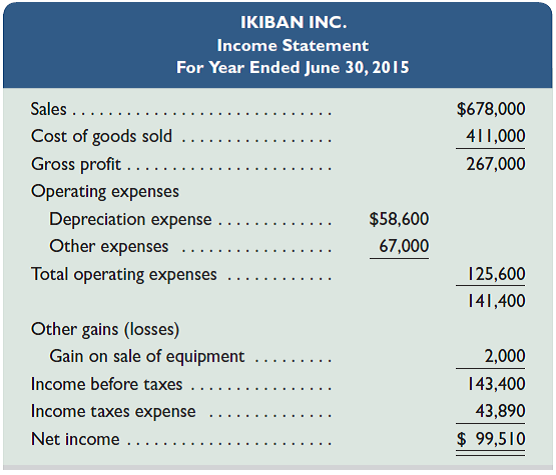

The following financial statements and additional information are reported.

Additional Information

a. A $30,000 note payable is retired at its $30,000 carrying (book) value in exchange for cash.

b. The only changes affecting retained earnings are net income and cash dividends paid.

c. New equipment is acquired for $57,600 cash.

d. Received cash for the sale of equipment that had cost $48,600, yielding a $2,000 gain.

e. Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement.

f. All purchases and sales of inventory are on credit.

Required

1. Prepare a statement of cash flows for the year ended June 30, 2015, using the indirect method.

2. Compute the company's cash flow on total assets ratio for its fiscal year 2015.

Additional Information

a. A $30,000 note payable is retired at its $30,000 carrying (book) value in exchange for cash.

b. The only changes affecting retained earnings are net income and cash dividends paid.

c. New equipment is acquired for $57,600 cash.

d. Received cash for the sale of equipment that had cost $48,600, yielding a $2,000 gain.

e. Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement.

f. All purchases and sales of inventory are on credit.

Required

1. Prepare a statement of cash flows for the year ended June 30, 2015, using the indirect method.

2. Compute the company's cash flow on total assets ratio for its fiscal year 2015.

Explanation

Cash flow statement

Cash flows statemen...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255