Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 6

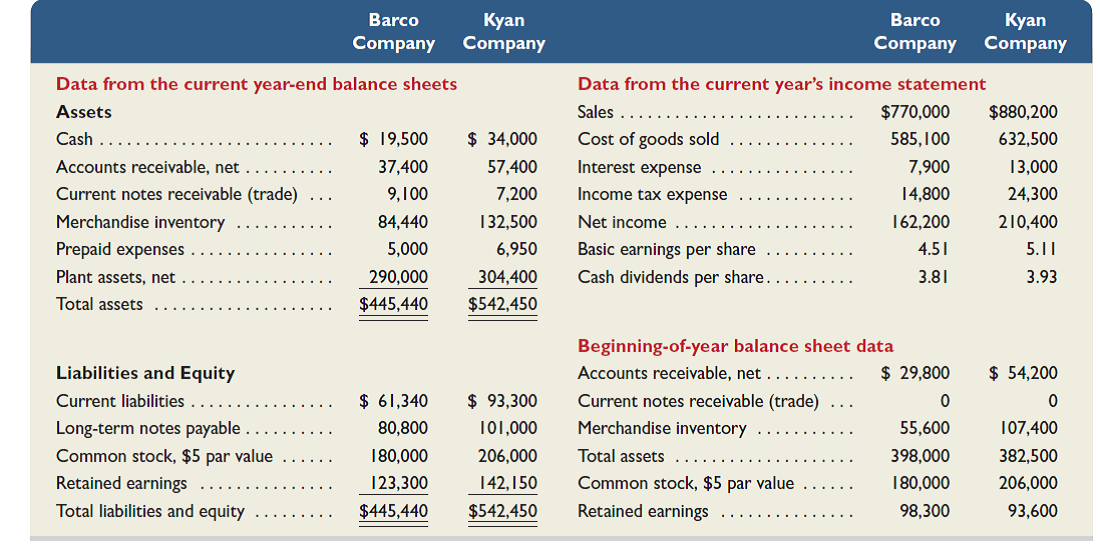

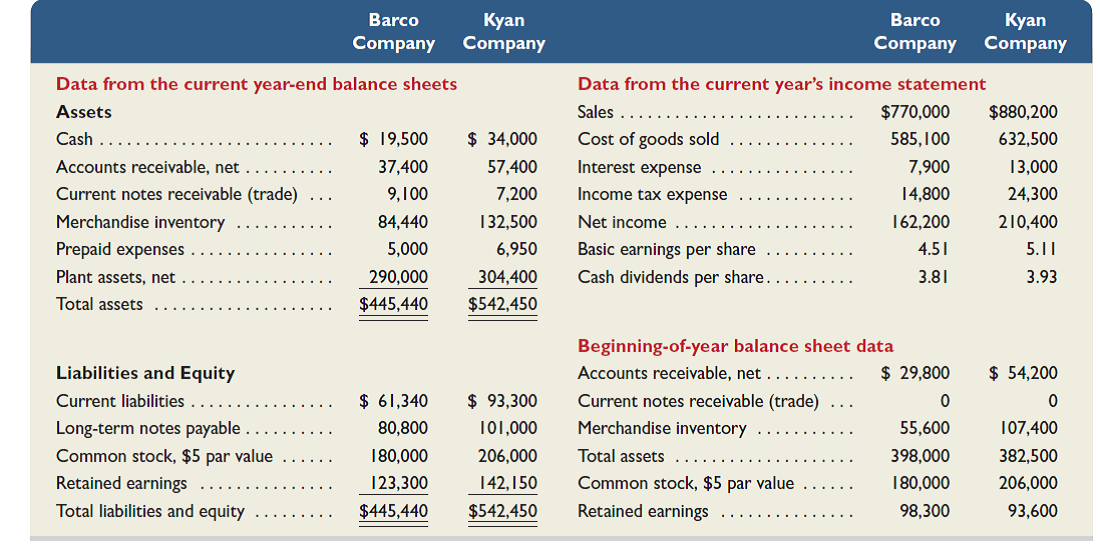

Summary information from the financial statements of two companies competing in the same industry follows.

Required

1. For both companies compute the ( a ) current ratio, ( b ) acid-test ratio, ( c ) accounts (including notes) receivable turnover, ( d ) inventory turnover, ( e ) days' sales in inventory, and ( f ) days' sales uncollected. Identify the company you consider to be the better short-term credit risk and explain why. Round to one decimal place.

2. For both companies compute the ( a ) profit margin ratio, ( b ) total asset turnover, ( c ) return on total assets, and ( d ) return on common stockholders' equity. Assuming that each company's stock can be purchased at $75 per share, compute their ( e ) price-earnings ratios and ( f ) dividend yields. Round to one decimal place. Identify which company's stock you would recommend as the better investment and explain why.

Required

1. For both companies compute the ( a ) current ratio, ( b ) acid-test ratio, ( c ) accounts (including notes) receivable turnover, ( d ) inventory turnover, ( e ) days' sales in inventory, and ( f ) days' sales uncollected. Identify the company you consider to be the better short-term credit risk and explain why. Round to one decimal place.

2. For both companies compute the ( a ) profit margin ratio, ( b ) total asset turnover, ( c ) return on total assets, and ( d ) return on common stockholders' equity. Assuming that each company's stock can be purchased at $75 per share, compute their ( e ) price-earnings ratios and ( f ) dividend yields. Round to one decimal place. Identify which company's stock you would recommend as the better investment and explain why.

Explanation

1.

a.

Current Ratio (CR) is liquidity ra...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255