Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 56

Refer to the information in Exercise 25-3 and assume instead that double-declining depreciation is applied. Compute the machine's payback period (ignore taxes). (Round the payback period to three decimals.)

Reference: Exercise 25-3

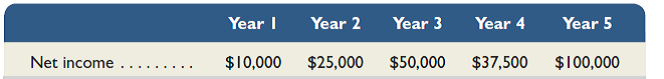

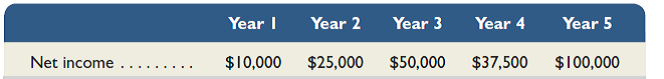

A machine can be purchased for $150,000 and used for five years, yielding the following net incomes. In projecting net incomes, straight-line depreciation is applied, using a five-year life and a zero salvage value. Compute the machine's payback period (ignore taxes). (Round the payback period to three decimals.)

Reference: Exercise 25-3

A machine can be purchased for $150,000 and used for five years, yielding the following net incomes. In projecting net incomes, straight-line depreciation is applied, using a five-year life and a zero salvage value. Compute the machine's payback period (ignore taxes). (Round the payback period to three decimals.)

Explanation

The term cash flow is usually used to de...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255