Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Edition 22ISBN: 978-0077862275 Exercise 48

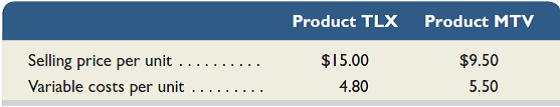

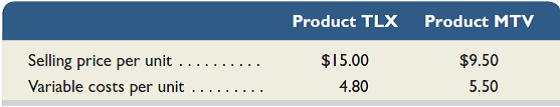

Colt Company owns a machine that can produce two specialized products. Production time for Product TLX is two units per hour and for Product MTV is five units per hour. The machine's capacity is 2,750 hours per year. Both products are sold to a single customer who has agreed to buy all of the company's output up to a maximum of 4,700 units of Product TLX and 2,500 units of Product MTV. Selling prices and variable costs per unit to produce the products follow. Determine (1) the company's most profitable sales mix and (2) the contribution margin that results from that sales mix.

Explanation

Decision making

Decision making is base...

Fundamental Accounting Principles 22th Edition by John Wild ,Ken Shaw,Barbara Chiappetta

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255