Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 54

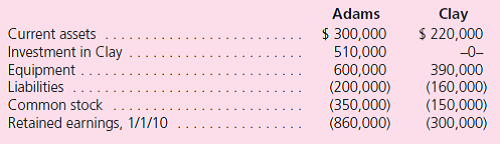

Adams, Inc., acquires Clay Corporation on January 1, 2010, in exchange for $510,000 cash.Immediately after the acquisition, the two companies have the following account balances.Clay's equipment (with a five-year life) is actually worth $440,000.Credit balances are indicated by parentheses.

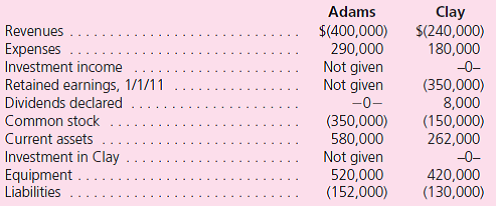

In 2010, Clay earns a net income of $55,000 and pays a $5,000 cash dividend.In 2010, Adams reports income from its own operations (exclusive of any income from Clay) of $125,000 and declares no dividends.At the end of 2011, selected account balances for the two companies are as follows:

a.What are the December 31, 2011, Investment Income and Investment in Clay account balances assuming Adams uses the:

1.Initial value method.

2.Equity method.

b.How does the parent's internal investment accounting method choice affect the amount reported for expenses in its December 31, 2011, consolidated income statement

c.How does the parent's internal investment accounting method choice affect the amount reported for equipment in its December 31, 2011, consolidated balance sheet

d.What is Adams's January 1, 2011, Retained Earnings account balance assuming Adams accounts for its investment in Clay using the:

1.Initial value method.

2.Equity method.

e.What worksheet adjustment to Adams's January 1, 2011, Retained Earnings account balance is required if Adams accounts for its investment in Clay using the initial value method

f.Prepare the worksheet entry to eliminate Clay's stockholders' equity.

g.What is consolidated net income for 2011

In 2010, Clay earns a net income of $55,000 and pays a $5,000 cash dividend.In 2010, Adams reports income from its own operations (exclusive of any income from Clay) of $125,000 and declares no dividends.At the end of 2011, selected account balances for the two companies are as follows:

a.What are the December 31, 2011, Investment Income and Investment in Clay account balances assuming Adams uses the:

1.Initial value method.

2.Equity method.

b.How does the parent's internal investment accounting method choice affect the amount reported for expenses in its December 31, 2011, consolidated income statement

c.How does the parent's internal investment accounting method choice affect the amount reported for equipment in its December 31, 2011, consolidated balance sheet

d.What is Adams's January 1, 2011, Retained Earnings account balance assuming Adams accounts for its investment in Clay using the:

1.Initial value method.

2.Equity method.

e.What worksheet adjustment to Adams's January 1, 2011, Retained Earnings account balance is required if Adams accounts for its investment in Clay using the initial value method

f.Prepare the worksheet entry to eliminate Clay's stockholders' equity.

g.What is consolidated net income for 2011

Explanation

Retained earnings:

It refers to the por...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255