Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 15

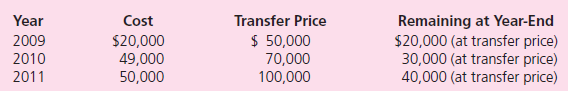

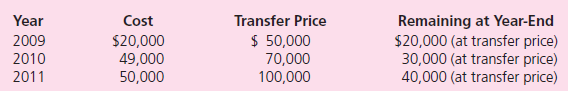

Anchovy acquired 90 percent of Yelton on January 1, 2009.Of Yelton's total acquisition-date fair value, $60,000 was allocated to undervalued equipment (with a 10-year life) and $80,000 was attributed to franchises (to be written off over a 20-year period).Since the takeover, Yelton has transferred inventory to its parent as follows:

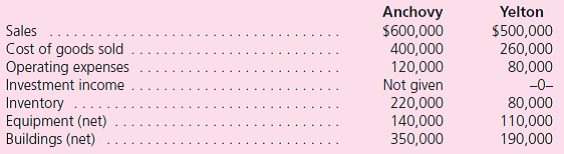

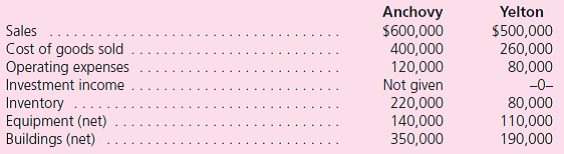

On January 1, 2010, Anchovy sold Yelton a building for $50,000 that had originally cost $70,000 but had only a $30,000 book value at the date of transfer.The building is estimated to have a fiveyear remaining life (straight-line depreciation is used with no salvage value).Selected figures from the December 31, 2011, trial balances of these two companies are as follows:

Determine consolidated totals for each of these account balances.

On January 1, 2010, Anchovy sold Yelton a building for $50,000 that had originally cost $70,000 but had only a $30,000 book value at the date of transfer.The building is estimated to have a fiveyear remaining life (straight-line depreciation is used with no salvage value).Selected figures from the December 31, 2011, trial balances of these two companies are as follows:

Determine consolidated totals for each of these account balances.

Explanation

Consolidated Financial Statement

Consol...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255