Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 58

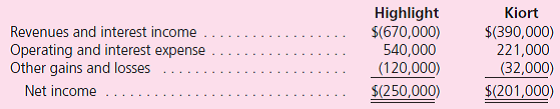

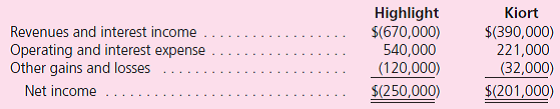

Highlight, Inc., owns all outstanding stock of Kiort Corporation.The two companies report the following balances for the year ending December 31, 2011:

On January 1, 2011, Highlight acquired on the open market bonds for $108,000 originally issued by Kiort.This investment had an effective rate of 8 percent.The bonds had a face value of $100,000 and a cash interest rate of 9 percent.At the date of acquisition, these bonds were shown as liabilities by Kiort with a book value of $84,000 (based on an effective rate of 11 percent).Determine the balances that should appear on a consolidated income statement for 2011.

On January 1, 2011, Highlight acquired on the open market bonds for $108,000 originally issued by Kiort.This investment had an effective rate of 8 percent.The bonds had a face value of $100,000 and a cash interest rate of 9 percent.At the date of acquisition, these bonds were shown as liabilities by Kiort with a book value of $84,000 (based on an effective rate of 11 percent).Determine the balances that should appear on a consolidated income statement for 2011.

Explanation

-Interest Expense to Be Eliminated = $84...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255