Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 7

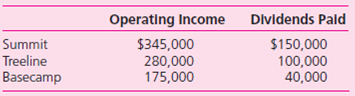

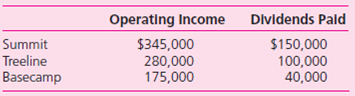

Summit owns a 90 percent majority voting interest in Treeline.In turn, Treeline owns a 70 percent majority voting interest in Basecamp.In the current year, each firm reports the following income and dividends.Operating income figures do not include any investment or dividend income.

In addition, in computing its income on a full accrual basis, Treeline's acquisition of Basecamp necessitates excess acquisition-date fair value over book value amortizations of $25,000 per year.Similarly, Summit's acquisition of Treeline requires $20,000 of excess fair-value amortizations.

Required

Prepare an Excel spreadsheet that computes the following:

1.Treeline's income including its equity in Basecamp earnings.

2.Summit's income including its equity in Treeline's total earnings.

3.Total entity net income for the three companies.

4.Total noncontrolling interest in the total entity's net income.

5.Difference between these elements:

• Summit's net income.

• Total entity net income for the three companies less noncontrolling interest in the total entity's net income.

( Hint: The difference between these two amounts should be zero.)

In addition, in computing its income on a full accrual basis, Treeline's acquisition of Basecamp necessitates excess acquisition-date fair value over book value amortizations of $25,000 per year.Similarly, Summit's acquisition of Treeline requires $20,000 of excess fair-value amortizations.

Required

Prepare an Excel spreadsheet that computes the following:

1.Treeline's income including its equity in Basecamp earnings.

2.Summit's income including its equity in Treeline's total earnings.

3.Total entity net income for the three companies.

4.Total noncontrolling interest in the total entity's net income.

5.Difference between these elements:

• Summit's net income.

• Total entity net income for the three companies less noncontrolling interest in the total entity's net income.

( Hint: The difference between these two amounts should be zero.)

Explanation

Dividends:

It refers to a payment made ...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255