Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 56

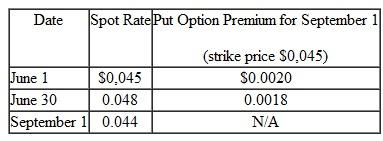

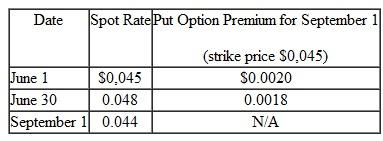

On June 1, Alexander Corporation sold goods to a foreign customer at a price of 1,000,000 pesos.It will receive payment in three months on September 1.On June 1, Alexander acquired an option to sell 1,000,000 pesos in three months at a strike price of $0,045.Relevant exchange rates and option premiums for the peso are as follows:  Alexander must close its books and prepare its second-quarter financial statements on June 30.

Alexander must close its books and prepare its second-quarter financial statements on June 30.

a.Assuming that Alexander designates the foreign currency option as a cash flow hedge of a foreign currency receivable, prepare journal entries for these transactions in U.S.dollars.What is the impact on net income over the two accounting periods

b.Assuming that Alexander designates the foreign currency option as a fair value hedge of a foreign currency receivable, prepare journal entries for these transactions in U.S.dollars.What is the impact on net income over the two accounting periods

Alexander must close its books and prepare its second-quarter financial statements on June 30.

Alexander must close its books and prepare its second-quarter financial statements on June 30.a.Assuming that Alexander designates the foreign currency option as a cash flow hedge of a foreign currency receivable, prepare journal entries for these transactions in U.S.dollars.What is the impact on net income over the two accounting periods

b.Assuming that Alexander designates the foreign currency option as a fair value hedge of a foreign currency receivable, prepare journal entries for these transactions in U.S.dollars.What is the impact on net income over the two accounting periods

Explanation

This problem requires knowledge of forwa...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255