Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 14

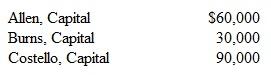

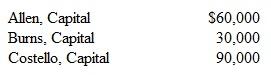

A partnership has the following capital balances:  Profits and losses are split as follows: Allen (20%), Burns (30%), and Costello (50%).Costello wants to leave the partnership and is paid $ 100,000 from the business based on provisions in the articles of partnership.If the partnership uses the bonus method, what is the balance of Burns's capital account after Costello withdraws a.$24,000.

Profits and losses are split as follows: Allen (20%), Burns (30%), and Costello (50%).Costello wants to leave the partnership and is paid $ 100,000 from the business based on provisions in the articles of partnership.If the partnership uses the bonus method, what is the balance of Burns's capital account after Costello withdraws a.$24,000.

B)$27,000.

C)$33,000.

D)$36,000.

Profits and losses are split as follows: Allen (20%), Burns (30%), and Costello (50%).Costello wants to leave the partnership and is paid $ 100,000 from the business based on provisions in the articles of partnership.If the partnership uses the bonus method, what is the balance of Burns's capital account after Costello withdraws a.$24,000.

Profits and losses are split as follows: Allen (20%), Burns (30%), and Costello (50%).Costello wants to leave the partnership and is paid $ 100,000 from the business based on provisions in the articles of partnership.If the partnership uses the bonus method, what is the balance of Burns's capital account after Costello withdraws a.$24,000.B)$27,000.

C)$33,000.

D)$36,000.

Explanation

The balance of B's capital account after...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255